The Bottom Line: Sustainable (SUSTAIN) bond and foreign fund indices beat their conventional benchmarks in May; SUSTAIN equity fund index lags by slight 3 bps.

US stock market in May recovers all but 10% of the February to March decline

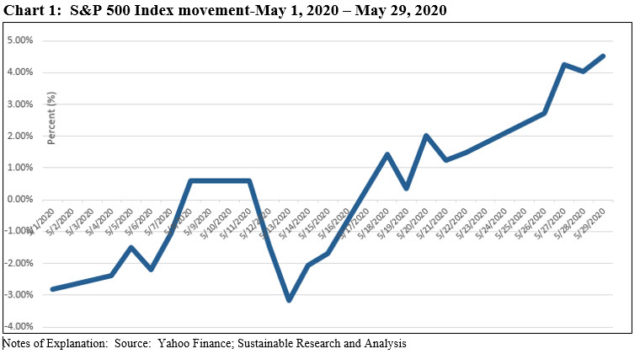

The stock market, which was down -33.92% from peak-to-trough on March 23, recovered all but 10% of the decline by the end of May as investor sentiment turned optimistic in response to the lifting of COVID-19 restrictions and infusion of extraordinary liquidity provided by governments and central bankers in the US and overseas. The market registered 13 positive trading days, or 65% of the time, adding an average of 0.23% per trading day.

While it wasn’t a smooth trajectory (Refer to Chart 1), markets continued on a recovery path that began in late March, with the S&P 500 adding 4.76% and the S&P 500 ESG Index posting a slightly lower 4.66% total return as investors moved into stocks that would benefit from the reopening of the economy. The NASDAQ Composite added 6.9% as growth trounced value stocks by as much as 3.6% among mid-cap companies that make up the S&P 400 Index. Even wider growth-to-value margins were recorded by corresponding Russell indices. Blended mid-cap and small cap stocks, according to S&P indices, were up 7.3% and 4.3%, respectively. At the same time, investment grade intermediate bonds, as measured by the Bloomberg Barclays US Aggregate Bond Index, posted a 0.47% gain on top of a 1.78% increase in April. The ESG equivalent benchmark was slightly behind at 0.42%. Non-investment grade corporates were up as much as 6.1% while intermediate-term bonds outperformed long-term instruments.

Overseas equity markets did not perform as well as their US counterparts. The MSCI ACWI, ex USA was up 3.3% while emerging markets were up a mere 0.8%.

Sustainable mutual funds and ETFs[1] post an average 4.43% gain

Sustainable funds combined, a total of 4,464 mutual funds and ETFs, recorded an average increase of 4.43% in May. Funds in this universe range from sustainable money market funds to alternative and commodity funds with combined total net assets of almost $2.6 trillion at the end of May. Returns ranged from a high of 21.89% registered by the Morgan Stanley Institutional Inception Fund, a fund that employs ESG integration and invests in small and emerging companies, to a low of -6.59% delivered by the Causeway Global Absolute Return Fund. The fund also employs an ESG integration approach in executing its long-short investment strategy that attempts to identify securities that will outperform or underperform an index of world companies.

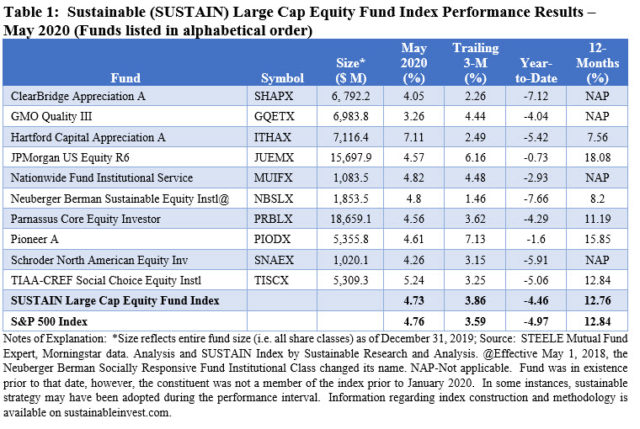

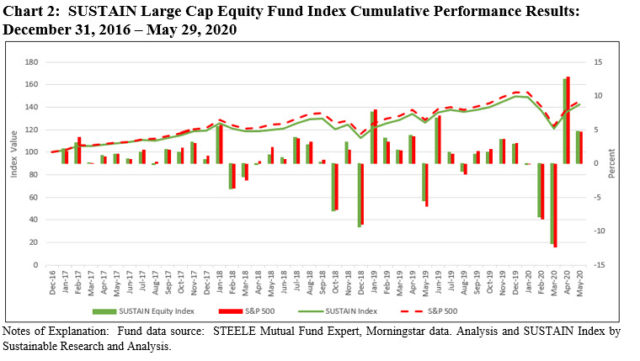

Sustainable (SUSTAIN) Large Cap Equity Fund Index fell behind S&P 500 by a slight 3 bps

The Sustainable (SUSTAIN) Large Cap Equity Fund Index recorded a gain of 4.73% in May based on the performance of its underlying members that ranged from a low of 3.26% to a high of 7.11%. Four of ten funds outperformed the S&P 500. The SUSTAIN Index, which generated a gain for the second consecutive month and is up 17.8% over the two-month interval, slightly lagged the S&P 500 by 3 basis points. Over the trailing 3-month and year-to-date time frames, the SUSTAIN Index led the S&P 500 by benefiting from the 54 bps advantage gained in March of this year. This is not the case, however, for the latest 12-months to May during which the SUSTAIN index lagged by a narrow 8 bps. The index also lags by 3.01% since inception of the SUSTAIN Index as of December 31, 2016. Refer to Table 1 and Chart 2.

Hartford Capital Appreciation Fund A was the best performing index member in May, up 7.11%, but it was also the worst performing fund at 7.56% over the trailing 12-months. The fund is managed by Wellington Management which, according to the fund’s Statement of Additional Information, may also consider certain environmental, social and/or governance (ESG) factors in its assessment of securities.

At the other end of the range in May, the GMO Quality Fund III, managed by Grantham, Mayo, Van Otterloo & Co. LLC, posted a lagging 3.26% increase in May. Like the Hartford fund, GMO may consider ESG factors in investment decisions. The fund was up 4.44% and -4.04% during the trailing three months and year-to-date time periods.

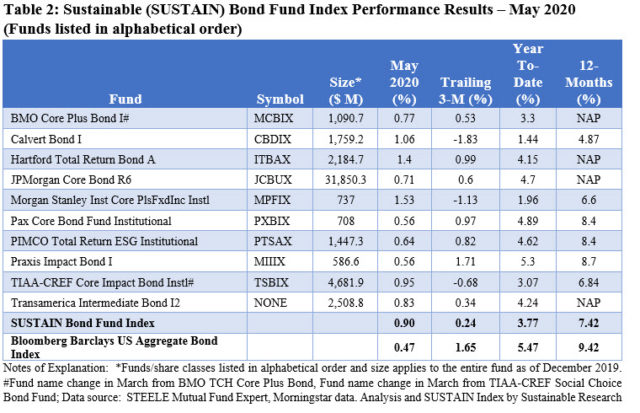

Sustainable (SUSTAIN) Bond Fund Index beat the conventional index by 43 bps

The SUSTAIN Bond Fund Index generated a 0.9% total return, and exceeded the 0.47% outcome recorded by the Bloomberg Barclays US Aggregate Bond Fund Index. All ten index members outperformed the conventional index, led by the Morgan Stanley Institutional Core Plus Fixed Income Fund Institutional that posted a 1.53% return. At the same time the fund ranked next to last on the basis of its trailing 12-month results. The fund’s investment process takes into account information about environmental, social and governance issues. In addition the fund manager conducts company management engagements around corporate governance practices as well as what the adviser and/or sub-adviser deem to be materially important environmental and/or social issues facing a company.

Two funds brought up the rear with identical results in May, including the Pax Core Bond Fund Institutional Shares and the Praxis Impact Bond I. Both funds posted a return of 0.56% but their approach to sustainable investing varies. The Pax Core Bond Fund invests in forward thinking companies with more sustainable business models. The adviser identifies those companies by combining rigorous financial analysis with equally rigorous sustainability or environmental, social and governance (ESG) analysis. The fund seeks to avoid companies that fail its exclusionary criteria on weapons and tobacco, that it determines are the subject of significant ESG controversy or that it determines significantly underperform their peers on key (but not necessarily all) ESG or sustainability criteria. The Praxis Impact Bond Fund, on the other hand, integrates ESG but also employs a philosophy of financial decision making that balances social and financial considerations so as to reflect certain core social values. The fund also avoids investments in U.S. Treasury bills, notes.

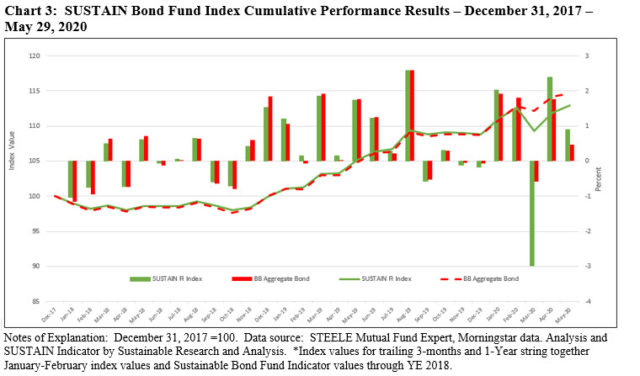

Since its inception as of December 31, 2017, the SUSTAIN Bond Fund Index lags its conventional counterpart by -1.78%. Refer to Table 2 and Chart 3.

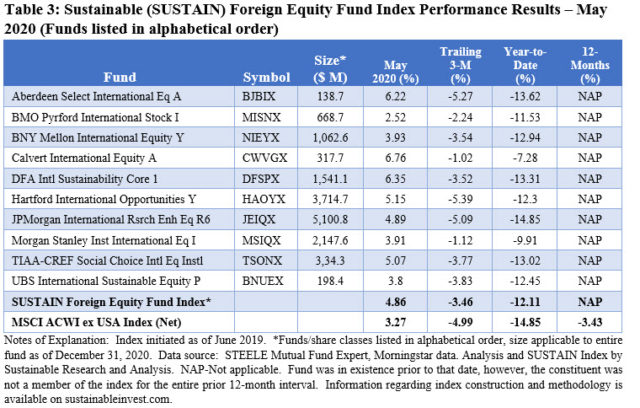

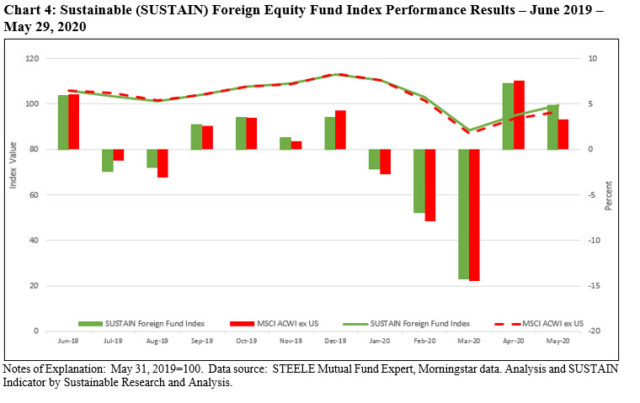

Sustainable (SUSTAIN) Foreign Equity Fund Index outperformed by 1.59%

The SUSTAIN Foreign Equity Fund Index posted a gain of 4.9%, eclipsing the MSCI ACWI, ex USA by a wide 1.59% margin. All but one of ten funds exceeded the performance of the conventional benchmark, led by the 6.76% increase registered by the Calvert International Equity Fund A that employs Calvert’s responsible investment criteria by encapsulating a combination of impact, exclusions, ESG integration as well as engagement and proxy voting strategies. The fund, which is managed by Eaton Vance Advisers International Ltd., has been benefiting from its growth-oriented bent, sector holdings as well as stock selection.

The fund is also the best performer over the last 3-months, year-to-date and, in particular since the inception of the index as of June 30, 2019. Coming in last is the BMO Pyrford International Stock I that gained 2.52% in May. An ESG integrator, the fund trailed the conventional benchmark by 75 bps, hampered by its 8.62% cash position, the highest of the ten funds, as well as it higher than average exposure to the greater Asia region.

The SUSTAIN Foreign Equity Fund Index leads its conventional counterpart by 2.78% since inception. Refer to Table 3 and Chart 4.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. These are not mutually exclusive and shareholder/bondholder engagement and proxy voting may be also be employed by any of the foregoing strategies.

Sustainable Indices in May 2020: Bond and foreign equity funds outperform

The Bottom Line: Sustainable (SUSTAIN) bond and foreign fund indices beat their conventional benchmarks in May; SUSTAIN equity fund index lags by slight 3 bps.

Share This Article:

The Bottom Line: Sustainable (SUSTAIN) bond and foreign fund indices beat their conventional benchmarks in May; SUSTAIN equity fund index lags by slight 3 bps.

US stock market in May recovers all but 10% of the February to March decline

The stock market, which was down -33.92% from peak-to-trough on March 23, recovered all but 10% of the decline by the end of May as investor sentiment turned optimistic in response to the lifting of COVID-19 restrictions and infusion of extraordinary liquidity provided by governments and central bankers in the US and overseas. The market registered 13 positive trading days, or 65% of the time, adding an average of 0.23% per trading day.

While it wasn’t a smooth trajectory (Refer to Chart 1), markets continued on a recovery path that began in late March, with the S&P 500 adding 4.76% and the S&P 500 ESG Index posting a slightly lower 4.66% total return as investors moved into stocks that would benefit from the reopening of the economy. The NASDAQ Composite added 6.9% as growth trounced value stocks by as much as 3.6% among mid-cap companies that make up the S&P 400 Index. Even wider growth-to-value margins were recorded by corresponding Russell indices. Blended mid-cap and small cap stocks, according to S&P indices, were up 7.3% and 4.3%, respectively. At the same time, investment grade intermediate bonds, as measured by the Bloomberg Barclays US Aggregate Bond Index, posted a 0.47% gain on top of a 1.78% increase in April. The ESG equivalent benchmark was slightly behind at 0.42%. Non-investment grade corporates were up as much as 6.1% while intermediate-term bonds outperformed long-term instruments.

Overseas equity markets did not perform as well as their US counterparts. The MSCI ACWI, ex USA was up 3.3% while emerging markets were up a mere 0.8%.

Sustainable mutual funds and ETFs[1] post an average 4.43% gain

Sustainable funds combined, a total of 4,464 mutual funds and ETFs, recorded an average increase of 4.43% in May. Funds in this universe range from sustainable money market funds to alternative and commodity funds with combined total net assets of almost $2.6 trillion at the end of May. Returns ranged from a high of 21.89% registered by the Morgan Stanley Institutional Inception Fund, a fund that employs ESG integration and invests in small and emerging companies, to a low of -6.59% delivered by the Causeway Global Absolute Return Fund. The fund also employs an ESG integration approach in executing its long-short investment strategy that attempts to identify securities that will outperform or underperform an index of world companies.

Sustainable (SUSTAIN) Large Cap Equity Fund Index fell behind S&P 500 by a slight 3 bps

The Sustainable (SUSTAIN) Large Cap Equity Fund Index recorded a gain of 4.73% in May based on the performance of its underlying members that ranged from a low of 3.26% to a high of 7.11%. Four of ten funds outperformed the S&P 500. The SUSTAIN Index, which generated a gain for the second consecutive month and is up 17.8% over the two-month interval, slightly lagged the S&P 500 by 3 basis points. Over the trailing 3-month and year-to-date time frames, the SUSTAIN Index led the S&P 500 by benefiting from the 54 bps advantage gained in March of this year. This is not the case, however, for the latest 12-months to May during which the SUSTAIN index lagged by a narrow 8 bps. The index also lags by 3.01% since inception of the SUSTAIN Index as of December 31, 2016. Refer to Table 1 and Chart 2.

Hartford Capital Appreciation Fund A was the best performing index member in May, up 7.11%, but it was also the worst performing fund at 7.56% over the trailing 12-months. The fund is managed by Wellington Management which, according to the fund’s Statement of Additional Information, may also consider certain environmental, social and/or governance (ESG) factors in its assessment of securities.

At the other end of the range in May, the GMO Quality Fund III, managed by Grantham, Mayo, Van Otterloo & Co. LLC, posted a lagging 3.26% increase in May. Like the Hartford fund, GMO may consider ESG factors in investment decisions. The fund was up 4.44% and -4.04% during the trailing three months and year-to-date time periods.

Sustainable (SUSTAIN) Bond Fund Index beat the conventional index by 43 bps

The SUSTAIN Bond Fund Index generated a 0.9% total return, and exceeded the 0.47% outcome recorded by the Bloomberg Barclays US Aggregate Bond Fund Index. All ten index members outperformed the conventional index, led by the Morgan Stanley Institutional Core Plus Fixed Income Fund Institutional that posted a 1.53% return. At the same time the fund ranked next to last on the basis of its trailing 12-month results. The fund’s investment process takes into account information about environmental, social and governance issues. In addition the fund manager conducts company management engagements around corporate governance practices as well as what the adviser and/or sub-adviser deem to be materially important environmental and/or social issues facing a company.

Two funds brought up the rear with identical results in May, including the Pax Core Bond Fund Institutional Shares and the Praxis Impact Bond I. Both funds posted a return of 0.56% but their approach to sustainable investing varies. The Pax Core Bond Fund invests in forward thinking companies with more sustainable business models. The adviser identifies those companies by combining rigorous financial analysis with equally rigorous sustainability or environmental, social and governance (ESG) analysis. The fund seeks to avoid companies that fail its exclusionary criteria on weapons and tobacco, that it determines are the subject of significant ESG controversy or that it determines significantly underperform their peers on key (but not necessarily all) ESG or sustainability criteria. The Praxis Impact Bond Fund, on the other hand, integrates ESG but also employs a philosophy of financial decision making that balances social and financial considerations so as to reflect certain core social values. The fund also avoids investments in U.S. Treasury bills, notes.

Since its inception as of December 31, 2017, the SUSTAIN Bond Fund Index lags its conventional counterpart by -1.78%. Refer to Table 2 and Chart 3.

Sustainable (SUSTAIN) Foreign Equity Fund Index outperformed by 1.59%

The SUSTAIN Foreign Equity Fund Index posted a gain of 4.9%, eclipsing the MSCI ACWI, ex USA by a wide 1.59% margin. All but one of ten funds exceeded the performance of the conventional benchmark, led by the 6.76% increase registered by the Calvert International Equity Fund A that employs Calvert’s responsible investment criteria by encapsulating a combination of impact, exclusions, ESG integration as well as engagement and proxy voting strategies. The fund, which is managed by Eaton Vance Advisers International Ltd., has been benefiting from its growth-oriented bent, sector holdings as well as stock selection.

The fund is also the best performer over the last 3-months, year-to-date and, in particular since the inception of the index as of June 30, 2019. Coming in last is the BMO Pyrford International Stock I that gained 2.52% in May. An ESG integrator, the fund trailed the conventional benchmark by 75 bps, hampered by its 8.62% cash position, the highest of the ten funds, as well as it higher than average exposure to the greater Asia region.

The SUSTAIN Foreign Equity Fund Index leads its conventional counterpart by 2.78% since inception. Refer to Table 3 and Chart 4.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. These are not mutually exclusive and shareholder/bondholder engagement and proxy voting may be also be employed by any of the foregoing strategies.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainableinvest.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact