The uptick in the importance of energy and environmental concerns disclosed in the latest National League of Cities (NLC) State of the Cities Report used as jumping off point to highlight expansion in sustainable municipal bond offerings

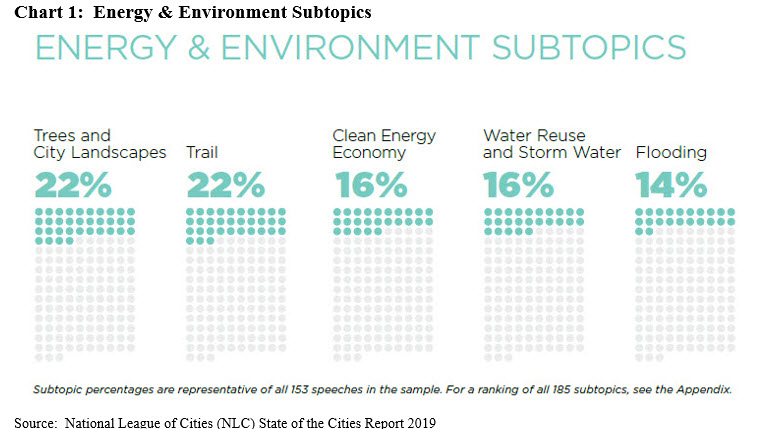

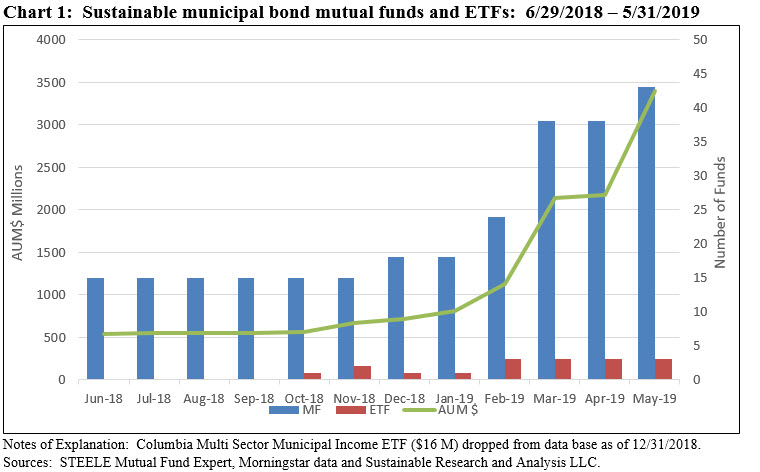

The National League of Cities (NLC) State of the Cities Report issued on May 23, 2019 spotlights the issues most critical to cities and how their mayors are finding solutions, based on content analysis of mayoral speeches delivered in early 2019. The NLC reports that in addition to health and human services that jumped three spots this past year relative to 2018, energy and environment also rose in importance this year, with 41% of mayors discussing the issue compared to only 25% last year. While not necessarily related, we use this finding to explore and highlight the recent expansion in the number of sustainable municipal fixed income mutual funds and ETFs now offered to investors. Over the last twelve months, the number of managers offering sustainable municipal funds increased from 5 firms to 8 firms, the number of mutual funds and ETFs expanded to 16, including 43 share classes, while total net assets jumped from $540 million to $3.4 billion at the end of May 2019. All 16 funds employ an ESG factor integration strategy either exclusively or in combination with one or more other sustainable investing approaches. Still, the number of municipal investing options for retail and institutional investors remain limited.

National League of Cities (NLC) State of the Cities Report spotlights economic, social and environmental issues most critical to cities

On May 23, the National League of Cities (NLC) released its 2019 State of the Cities Report, a report that analyzes 153 mayors’ state of the city addresses and spotlights the issues most critical to cities, and how their mayors are finding solutions. Now in its sixth year, the report analyzed the content of speeches delivered between January and April 2019 based on parts of the mayors’ speeches that articulate specific plans, goals and impacts related to projects, programs and city departments. Speeches are coded as having significantly covered a major topic if the word count for that topic constitutes at least 10% of the speech. The analysis reveals that the top 10 issues include: Economic development (74%), infrastructure (57%), health and human services (46%), energy and the environment (41%), budget and maintenance (41%), housing (38%), public safety (37%), demographics (32%), education (20%) and government data and technology (11%).

Not surprisingly, the priorities of cities, on a combined basis, revolve around various economic, infrastructure and social issues, but in terms of elevated priorities, in addition to health and human services that jumped three spots this past year, energy and environment also rose in importance this year, with 41% of mayors discussing the issue compared to only 25% last year. Mayors, according to the NLC report, introduced concrete plans to for enhancing neighborhood vitality through expanded tree coverage and improved city landscapes. The link to the complete report is here.

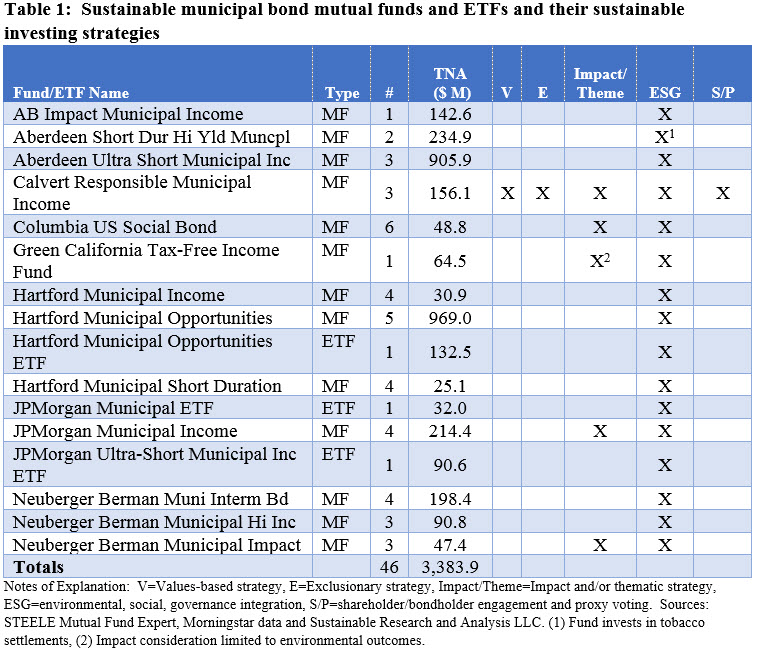

According to the report, cities are continuing to promote sustainability by planting trees to improve air quality and upgrading waste management systems to reduce waste and decrease contamination among recyclables. Within the context of this discussion, important subtopics include trees and city landscapes (22%), trail (22%), clean energy economy (16%), water reuse and storm water (16%) and flooding (14%). Refer to Chart 1.

Expanded number of sustainable municipal mutual funds and ETFs across varying strategies available to investors

While not linked, we use the NCL report to explore and highlight the expansion in the number of sustainable municipal fixed income mutual funds and ETFs now offered to retail as well as institutional investors. As of May 31, 2019, a total of 13 sustainable mutual funds (43 share classes in total offered across varying pricing structures) and three ETFs, for a total of 16 funds, managed by eight firms, are available to investors. This compares to just five sustainable municipal mutual fund offerings managed by five firms, 15 share classes in total, with $540 million in net assets as of June 30, 2018. Refer to Chart 1. Since the start of the year, sustainable municipal bond fund assets gained almost $2.7 billion largely due to fund re-brandings, that is to say existing funds that have formally adopted sustainable investing strategies or approaches to investment management by amending prospectus language. At least 16 share classes and 63% of the assets are available and attributable to institutional investors.

The municipal offerings consist of funds with investment objectives that range from current income by investing in ultra-short and short-term municipal securities to capital appreciation by investing in high yield, i.e. non-investment-grade, securities. Further, all 13 funds (43 share classes) and 3 ETFs employ an ESG factor integration strategy either exclusively or in combination with one or more of the following: value-based considerations, negative screening, impact investing and bondholder advocacy. The available underlying funds are listed in Table 1, along with their combined assets under management and sustainable investing strategies. For further details, also refer to the Funds Directory tab for additional details regarding the fund’s sustainable investing strategies.

Still, the sustainable municipal investing options are somewhat limited as to fund managers, fund types, as well as pricing alternatives.