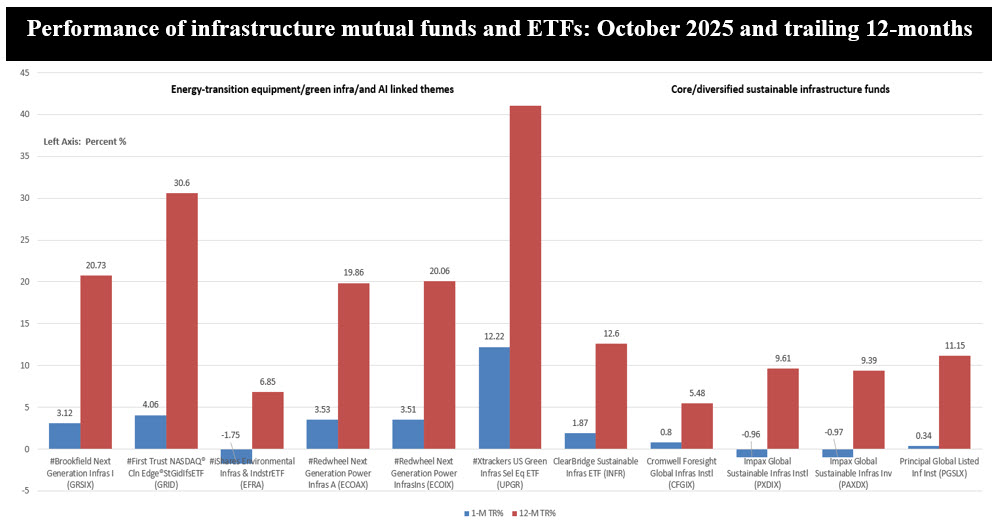

Sustainable Bottom Line: Smart-grid and electrification themes drove recent strong gains while core infrastructure strategies lagged, creating a performance divide across various sustainable infrastructure funds.

Notes of Explanation: ETFs and all mutual fund share classes displayed. Sources: Fund prospectuses, Morningstar and Sustainable Research and Analysis LLC.

Observations:

• While the number of focused sustainable mutual funds and ETFs classified as Infrastructure funds by Morningstar has been shrinking*, the category has doubled in size over the past ten months. The category, now consisting of nine active and passively managed funds with $5.2 billion in assets under management, ranks 13th among 74 long-term investment categories that make up the focused sustainable funds segment.

• Sustainable infrastructure funds, or funds that invest in the equities of companies that provide or maintain essential infrastructure, such as utilities, airports, roads, and communication networks, have gained $2.6 billion in assets, up from $2.6 billion as of December 31, 2024.

• That said, much of the gain is attributable to the growth in assets experienced by the $4.7 billion First Trust NASDAQ Clean Edge Smart Grid Infrastructure ETF (GRID). The fund, which accounts for 90% of the category’s assets, is a theme-based index ETF that invests entirely in companies deriving the majority of their revenues from smart grid or electrification technologies. The fund does not explicitly integrate ESG into its investment decision making nor does it apply any sustainability screens or exclude any companies based on ESG screening or related criteria. The other funds in the category range in size of assets between $5.4 million (iShares Environmental Infrastructure and Industrials ETF) to $225.1 million (Redwood Next Generation Power Infrastructure Fund).

• On the other hand, the eight other funds employ various sustainability screens and exclusions. A subset of these eight funds includes one fund that also emphasizes high ESG scoring firms while another relies on ESG integration and risk assessment to avoid poor ESG performers. An example of a fund that falls into this subset is the Brookfield Next Generation Infrastructure Fund (GRSIX) that screens for high ESG scores and avoids fossil fuels, tobacco, weapons, and companies violating UN Global Compact.

• The category of nine funds posted an average gain of 2.3% in October and an average of 17.2% over the trailing twelve months. Across listed infrastructure, recent performance has been defined by a fund’s positioning relative to three key performance drivers. These are (1) The electrification and data center/AI power demand. Utilities and equipment makers tied to grid expansion, high-voltage cables and transmission, and grid-hardening have seen improving earnings expectations as estimates of required grid capex keep rising (trillions globally over the coming decades), (2) Policy and subsidy tailwinds. Ongoing impacts of the U.S. Inflation Reduction Act, EU Green Deal and similar policies are still flowing into order books for grid, renewables and related equipment, and (3) “Peak rates” narrative. As markets increasingly price in that we’re past peak policy rates, long-duration, cash-flow-stable assets like listed infrastructure have generally benefited versus earlier in the hiking cycle.

• Against this backdrop, recent performance results have been bifurcated and defined by how the nine funds aligned with the key performance drivers. The top 12-month performers are funds with the highest exposure to energy-transition equipment, green infrastructure and AI-linked power themes. These include the Brookfield Next Generation Infrastructure Fund, First Trust NASDAQ Clean Edge Smart Grid Infrastructure ETF, Redwheel Next Generation Power Infrastructure Fund (ECOAX and ECOIX) (formerly Ecofin Global), Xtrackers US Green Infrastructure Select ETF (UPGR), and to a lesser degree, iShares Environmental Infrastructure and Industrial ETF (EFRA), that on a combined basis posted average returns of 4.1% in October and 23.4% over the trailing 12 months. The funds with the highest exposure to core/diversified sustainable infrastructure (towers, toll roads, diversified utilities, water), including ClearBridge Sustainable Infrastructure ETF (INFR), Cromwell Foresight Global Infrastructure (GFGIX), Impax Global Sustainable Infrastructure Fund (PXDIX and PAXDX) and Principal Global Listed Infrastructure (PGSLX) posted respectable but lower returns, with some short-term drag from earlier rate fears and, for sustainable funds, from exclusions of traditional energy.

*Liquidations since the start of the year include the BlackRock Infrastructure Sust Opps Fund, JPMorgan Sustainable Infrastructure ETF, Kayne Anderson Renewable Infrastructure, Macquarie Global Listed Infrastructure ETF and VanEck Green Infrastructure ETF. Each of these funds failed to exceed $20 million in AUM.