Citigroup issues €1 billion three-year fixed-rate green note

Last week Citigroup, whose senior debt is rated Baa1/BBB+, became the latest in a string of large US banks operating in the US to issue a green bond. Citigroup is the fourth bank among the top 10 ranked financial institutions to issue a green bond, having been preceded by Bank of America Corp. which was the first to market with a green bond back in 2013. Since then, green bonds have also been brought to market by Morgan Stanley and TD Bank Group.

Advancing Citigroup’s $100 Billion Environmental Finance Goal to support sustainable growth as part of Citigroup’s Sustainable Progress Strategy, Citigroup issued a €1 billion three-year fixed-rate note and will use the proceeds to fund renewable energy, sustainable transportation, water quality and conservation, energy efficiency and green building projects. These project categories align with the use of proceeds guideposts established pursuant to the Green Bond Principles that Citi helped craft in 2014. The Green Bond Principles are voluntary guidelines for the development and issuance of green bonds that encourage transparency, disclosure and integrity in the development of the green bond market, including reliance on an external party review. In the case of its offering, Citigroup’s note carried a third party assessment issued by Sustainalytics.

Citigroup’s offering was reportedly greeted with strong demand, including likely demand from an increasing number of dedicated green bond funds

Demand was strong and the note was reported to have been priced competitively compared with other markets. Green bonds, which are no different than conventional bonds except that their proceeds are earmarked for environmentally beneficial purposes, will typically price in line with their non-green bond counterparts given similar seniority, credit rating levels and maturities. Increasing demand for sustainable investing worldwide and in the US is motivating mainstream investment management firms to launch dedicated sustainable investment products generally and green bond investment vehicles in particular. Just in the last two months, the number of green bond funds in the US doubled with the launch of green bond mutual funds or exchange-traded funds (ETFs) by Allianz Global Investors, BlackRock and Teachers Advisors. This brings to six the number of green bond funds available to retail and institutional investors, including a combined total of four mutual funds as well as two ETFs with $286.9 million in total net assets as of year-end 2018. These active and passively managed dedicated green bond funds are dominated by corporate debt that, as of year-end 2018, accounted for between 42.09% and 66.3% of portfolio assets. Also due to issuance patterns and mandates, these portfolios are typically concentrated in investment-grade debt instruments where Citigroup’s notes will fit in. As of December 31, 2018, the three seasoned portfolios managed by Calvert Investments, Mirova, a unit of Natixis Global Asset Management, and Van Eck Associates maintained an average exposure of 68.7% to A1/A or better rated green bonds while an average of 20.83% was invested in Baa1/BBB rated bonds. Given Citigroup’s Baa1/BBB+ ratings, the slight yield pick-up will have been attractive to green bond funds in particular but more generally, sustainable funds more generally as well as conventional bond funds denominated in Euros or with the flexibility to invest in other than base currencies.

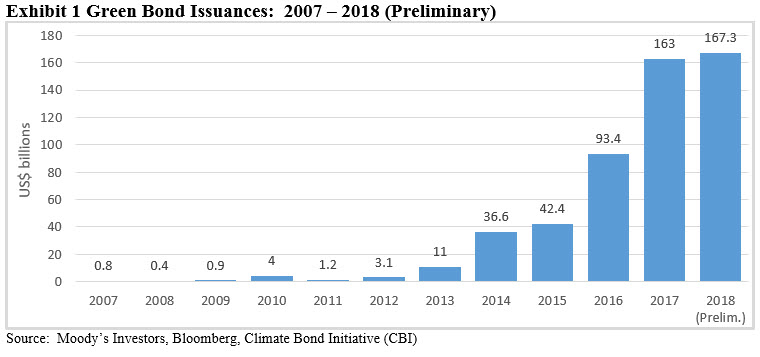

In 2018 green bond issuance reached a preliminary $167.3 billion and this number is expected to reach higher in 2019

The issuance of green bonds across the world continues to expand since their introduction in 2007. Last year’s issuance reached $167.3 billion, based on preliminary data, and in 2019 green bond volume is expected to exceed that level. Since 2007, an estimated $524.1 billion in green bonds have been issued by hundreds of issuers across the globe, including development banks, such as the World Bank, sovereigns, such as France and Poland, sub-sovereigns and municipalities, which may include taxable and tax exempt instruments, financial institutions and various corporations, and in the form of project finance transactions and securitizations, such as automobiles and residential mortgages.

Key reason for the growth and development of green bonds is their role in mobilizing capital toward climate solutions

A key reason for the growth and development of green bonds is their role in mobilizing capital toward climate solutions. The success of the UN Paris climate agreement that was negotiated at the end of 2015 and went into effect in November 2016 which aims to reduce greenhouse gas emissions to net zero levels between 2055 and 2070 so as to achieve a targeted 2° or even lower 1.5° Centigrade limit on the warming of the earth’s surface temperatures to avoid catastrophic climate change will require an unprecedented allocation of capital, measured in trillions of dollars a year. To this end, green bonds are gaining attention for their potential role in mobilizing capital toward climate solutions. Although traditional finance techniques will also have to be mobilized for this effort, the need to finance climate solutions in combination with growing investor demand should continue to lift green bond issuance beyond 2018.

Notes of Explanation and data sources: Total net assets: STEELE Mutual Fund Systems, Morningstar data; otherwise, fund websites and analysis by Sustainable Research and Analysis LLC. Green bonds portfolio data represents arithmetic averages.