The Bottom Line:

A number of dedicated green bond funds so far may offer investors an opportunity to “do their bit” without sacrificing conventional returns.

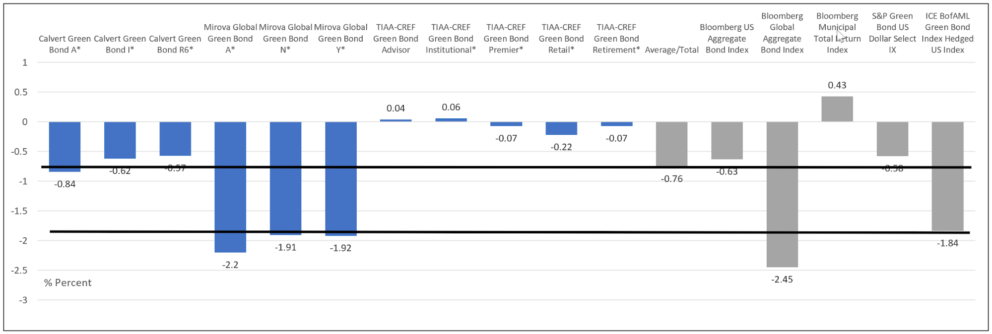

Performance of three green bond funds: 3-year annualized results through July 31, 2022 Notes of Explanation: The three green bond funds have been in operation for at least three years and managed without a change in investment mandate. *Fund invests in US and non-US dollar securities. Sources: Morningstar Direct, fund disclosures and Sustainable Research and Analysis LLC.

Notes of Explanation: The three green bond funds have been in operation for at least three years and managed without a change in investment mandate. *Fund invests in US and non-US dollar securities. Sources: Morningstar Direct, fund disclosures and Sustainable Research and Analysis LLC.

Observations:

- There has been much attention focused on the so called greenium associated with the issuance of green bonds, or the gap between what investors are willing to pay for green bonds versus traditional equivalent bonds. Less attention has been directed on the impact of the greenium on investors, either direct investors or via registered investment companies.

- According to a recently published paper by John Caramichael and Andreas C. Rapp with the Board of Governors of the Federal Reserve System¹, the authors found that, on average, green bonds have a yield spread that is 8 basis points lower relative to conventional bonds. That means that companies issuing green bonds enjoy funding cost advantages as compared to their conventional debt. It should be noted that the greenium is not level across all green bonds. The same study reports that the greenium is unevenly distributed to large, investment-grade issuers, primarily within the banking sector and developed economies. Also, another recent report indicates that the greenium in Europe has declined to between 1 and 2 basis points today.

- While advantageous for issuers of green bonds, investors on the other hand must be willing to accept potentially lower returns over time. That said, it seems that in some cases effective active portfolio management can offer investors who wish to “do their bit” and allocate capital to projects that address climate change, have an opportunity do so without sacrificing conventional returns through green bond investments.

- There are currently in the US seven green bond funds in operation with $1,453.4 million in assets, consisting of three index tracking ETFs and four actively managed mutual funds. These funds, however, are relatively new or their mandates have been updated such that they have not established a long track record. Four funds, including Franklin Municipal Green Bond ETF, iShares USD Green Bond ETF, PIMCO Climate Bond Fund and VanEck Green Bond ETF², fall into this category and only three funds have been in operation with a consistent investment mandate over the trailing three-year interval through July 31, 2022. One of these, the Calvert Green Bond Fund has been in operation longer.

- The three funds are alike in that they are actively managed, and they each invest in non-US dollar denominated green bonds in addition to USD green bonds, to varying degrees. Each of the three funds have outperformed the narrowly configured green bond-oriented ICE BofAML Green Bond Index Hedged US Index but the field of outperformance narrows when total return results are compared to a broad-based conventional benchmark widely used for relative performance evaluation by US investors, namely the Bloomberg US Aggregate Bond Index. The Mirova Global Green Bond Fund and each of its three share classes underperformed. But at the same time, all five share classes of the TIAA-CREF Green Bond Fund excelled along with two share classes offered by the Calvert Green Bond Fund. The latter, however, require minimum investments starting at $1 million.

- The TIAA-CREF Green Bond Fund that offers a retail share class and which has beaten the conventional benchmark over the trailing three years by between 41 bps and 69 bps (annualized) across its five share classes, net of their varying and not lowest expense ratios, illustrates that effective active management can overcome the green bond greenium and offer retail as well as institutional investors competitive returns with limited additional risk. At the same time, this investment option allows investors to “do their bit” and allocate capital to projects that address climate change.have

¹The Green Corporate Bond Issuance Premium, John Caramichael and Andreas Rapp, June 2022. ²These funds are either relatively new or their mandates were updated. In the case of the iShares USD Green Bond ETF and VanEck Green Bond ETF, their investment mandate was updated within the 3-year interval to restrict green bonds to USD denominated instruments.