The Bottom Line: The article describes in detail the three sustainable (SUSTAIN) mutual fund indices, their construction methodology, index constituents and corresponding sustainable investing strategies.

Summary

The Sustainable (SUSTAIN) funds indices, including the Sustainable (SUSTAIN) Large Cap Equity Fund Index, Sustainable (SUSTAIN) Bond Fund Index and the Sustainable (SUSTAIN) Foreign Equity Fund Index, are designed to track the total return performance of three sectors of the actively managed sustainable mutual funds and exchange-traded funds (ETF) market segment. These indices track the performance of like funds based on their investment and sustainable strategy[1] approaches. In each instance, the indices track the performance of the largest share class of the ten largest actively managed qualifying mutual funds and ETFs.

Key Uses

-Track the performance of the large cap domestic equity segment, intermediate investment-grade and foreign large cap equity funds segments of the sustainable investment funds sector.

-Compare and evaluate the performance of similarly managed sustainable investment funds.

-Understand the tradeoffs, if any, between investing in conventional actively managed funds and ones that employs sustainable investment strategies or approaches.

-Creation of investment products.

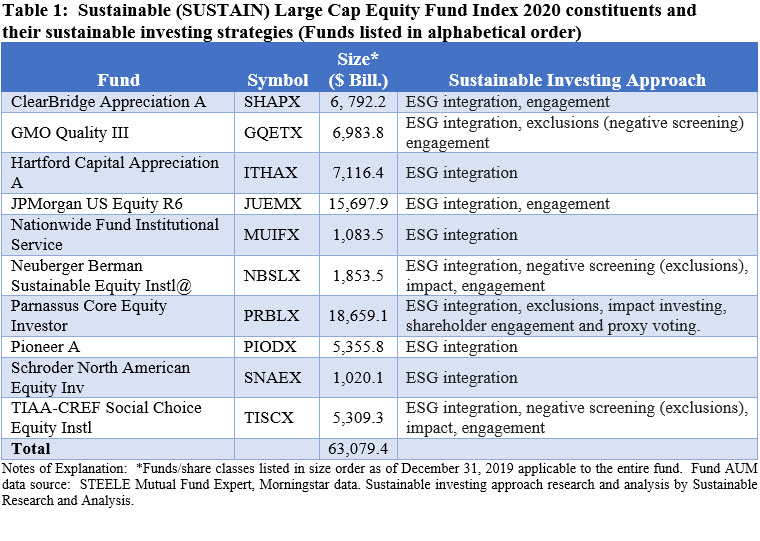

Sustainable (SUSTAIN) Large Cap Equity Fund Index

The index, which was initiated as of June 30, 2017 with data back to December 31, 2016, tracks the total return performance of the ten largest actively managed large cap blend domestic equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. In effect, these funds employ an ESG integration strategy either exclusively or in combination with negative screening (exclusions), achievement of impact, and/or engagement with investee companies.

To qualify for inclusion in the index the following conditions must be satisfied by each fund as of the December 31st rebalancing date: (1) Actively managed, (2) Fund (entire fund) net assets ≥$50 million, (3) Fund must be classified as a large cap blend domestic equity fund. The fund’s category classification is determined based on a review of the fund’s investment objective, strategy, comparative index used for relative performance evaluation purposes as well as Morningstar’s classification. At the same time, a fund must actively apply environmental, social and governance (ESG) criteria to its investment processes and decision making. This is evidenced by the fund’s adoption of ESG integration language in its prospectus or Statement of Additional Information (SAI). In tandem with their ESG integration strategy, some funds may also employ exclusionary strategies, impact oriented investment approaches and/or engage with investee companies.

Since December 31, 2018, only the largest single fund or share class managed by an investment management firm is included in the index. This was not the case previously. Also, a fund with multiple share classes is only included in the index once, based on the largest share class in terms of net assets. The index is equally weighted, it is calculated monthly and rebalanced once a year as of December 31.

The Sustainable (SUSTAIN) Large Cap Equity Fund Index was reconstituted as of December 31, 2019 to reflect changes that occurred during 2019 in the profile of the sustainable US equity universe of mutual funds due to the expansion in the number of funds offered in this market segment by mainstream investment management firms and the universe of available like funds from which to select the ten index constituents. The expansion in the universe of funds also permitted a refinement in the style of large cap funds to constrain these around a large cap blend style. As a result, the 2020 index profile reflects the substitution of four funds. The new funds include: ClearBridge Appreciation A, GMO Quality III, Nationwide Fund Institutional Service Shares and Schroder North America Equity Inv Shares. These funds replaced Calvert Equity Fund Class A, Pax Large Cap Fund Institutional Class, Putnam Sustainable Leaders A and VALIC Company II Socially Responsible Fund. Refer to Table 1.

The combined assets associated with the ten Index constituent funds stood at $63.1 billion and represent about 9.6% of the entire actively managed sustainable US equity sector comprised of 1,028 funds/share classes with total net assets of $654.8 billion. Further, the index member funds make up 11.3% of the 672 funds/share classes with $558.1 billion in actively managed large cap blend funds as of December 31, 2019.

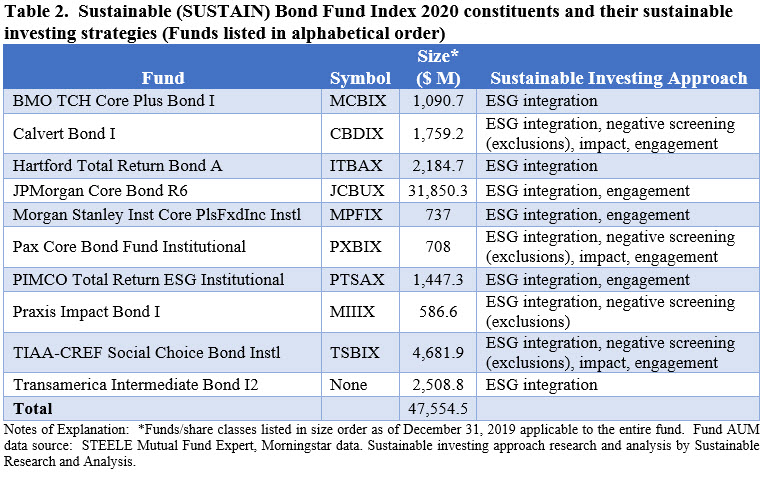

Sustainable (SUSTAIN) Bond Fund Index Explained

The index, which was initiated as of December 31, 2017 with only five funds, now tracks the total return performance of the ten largest actively managed intermediate investment-grade bond mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. Like its equity fund counterpart, to qualify for inclusion in the index, the following conditions must be satisfied by each fund as of the December 31st rebalancing date: (1) Actively managed, (2) Fund (entire fund) net assets ≥$50 million, (3) Fund must classified as an intermediate investment-grade bond fund. The fund’s category classification is determined based on a review of the fund’s investment objective, strategy, comparative index used for relative performance evaluation purposes as well as Morningstar’s classification. At the same time, a fund must actively apply environmental, social and governance (ESG) criteria to its investment processes and decision making. This is evidenced by the fund’s adoption of ESG integration language in its prospectus or Statement of Additional Information (SAI). In tandem with their ESG integration strategy, some funds may also employ exclusionary strategies, impact oriented investment approaches and/or engage with investee companies.

The Sustainable (SUSTAIN) Bond Fund Index was reconstituted as of December 31, 2019 to reflect changes that occurred during 2019 in the profile of the sustainable US taxable bond universe of mutual funds due to the expansion in the number of funds offered in this market segment by mainstream investment management firms and the expansion in the universe of available like funds from which to select the ten index constituents. As a result, the 2020 index profile reflects the substitution of four funds. These include BMO TCH Core Plus Bond I Shares, Hartford Total Return Bond A, JPMorgan Core Bond R6, and Transamerica Intermediate Bond I2. These funds replaced Aberdeen Total Return Bond I, Domini Impact Bond Investor, Parnassus Fixed Income and Touchstone Impact Bond Institutional Shares.

The combined assets associated with the ten Index constituent funds stood at $47.6 billion and represents about 16.9% of the entire actively managed sustainable taxable funds sector comprised of 768 funds/share classes with total net assets of $281.6 billion. Further, it represents 53.8% of the 195 funds/share classes with $88.4 billion in actively managed intermediate core and intermediate core plus funds as of December 31, 2019.

Effective December 31, 2018, only the largest single fund or share class managed by an investment management firm will be included in the index. Also, a fund with multiple share classes is only included in the index once, based on the largest share class in terms of net assets. The index is equally weighted, it is calculated monthly and rebalanced once a year as of December 31.

At the time it was constructed as of December 31, 2017 less than 10 funds qualified under the criteria set forth above and for this reason to distinguish this measure from a more robust one in terms of number of constituent funds, the benchmark was referred to as an indicator rather than an index. The SUSTAIN Bond Fund Indicator was upgraded to an index with the addition of five actively managed sustainable fixed income funds that are pursuing investment-grade intermediate term mandates in line with the Bloomberg Barclays US Aggregate Index that, at the same time, employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. The upgrade reflects changes that occurred during 2018 in the profile of the sustainable taxable fixed income universe of mutual funds due to the expansion in the number of funds offered in this market segment by mainstream investment management firms and the expansion in the universe of available like funds.

The expanded SUSTAIN Bond Fund Index is now comprised of the ten largest qualifying funds, including the following mutual funds/share classes that have been added as of December 31, 2018: Morgan Stanley Institutional Core Plus Fixed Income Institutional Shares, Touchstone Impact Bond Institutional, Aberdeen Total Return Bond I, Parnassus Fixed Income and Domini Impact Bond Investor. Refer to Table 2.

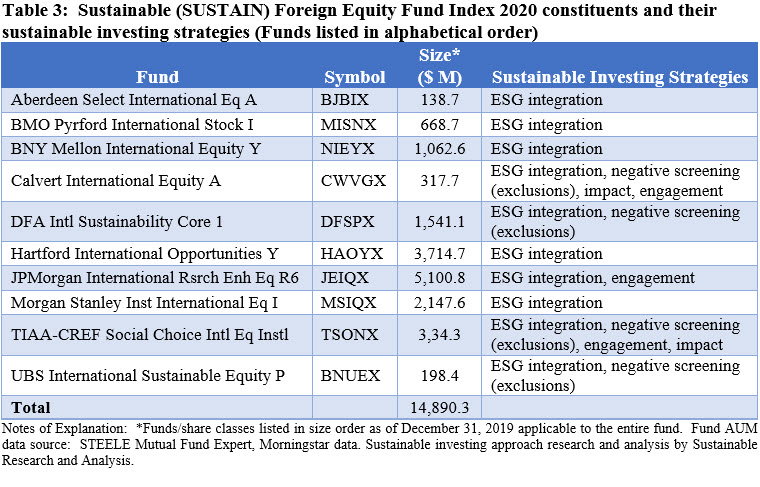

Sustainable (SUSTAIN) Foreign Equity Fund Index Explained

The index, which was initiated as of June 30, 2019, tracks the total return performance of the ten largest actively managed foreign equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. Like its US equity and fixed income counterparts, to qualify for inclusion in the index, the following conditions must be satisfied by each fund as of the December 31st rebalancing date: (1) Actively managed, (2) Fund (entire fund) net assets ≥$50 million, (3) Fund must classified as a foreign equity fund. Eligible foreign mutual funds are selected from the universe of foreign funds that generally align themselves to the performance of the MSCI All Country World, ex US Index. The fund’s category classification is determined based on a review of the fund’s investment objective, strategy, comparative index used for relative performance evaluation purposes as well as Morningstar’s classification. At the same time, a fund must actively apply environmental, social and governance (ESG) criteria to its investment processes and decision making. This is evidenced by the fund’s adoption of ESG integration language in its prospectus or Statement of Additional Information (SAI). In tandem with their ESG integration strategy, some funds may also employ exclusionary strategies, impact oriented investment approaches and/or engage with investee companies.

Only the largest single fund or share class managed by an investment management firm is included in the index. Also, a fund with multiple share classes is only included in the index once, based on the largest share class in terms of net assets. The index is equally weighted, it is calculated monthly and rebalanced once a year as of December 31.

The Sustainable (SUSTAIN) Foreign Equity Fund was reconstituted as of December 31, 2019 to reflect changes that occurred during 2019 as well as a refinement in the style of funds to constrain these around a large cap blend style as much as possible. As a result, the 2020 index profile reflects the substitution of four funds. The new funds include: Aberdeen Select International Equity A, BMO Pyrford International Stock I and Calvert International Equity A. These funds replaced Boston Common ESG Impact International, Domini Impact International Equity Institutional and Templeton Institutional International Equity Ser Primary. Refer to Table 3.

The combined assets associated with the ten funds that comprise the index as of December 31, 2019 stood at $14.9 billion and represent about 7.5% of the entire actively managed sustainable foreign funds sector comprised of 745 funds/share classes with total net assets of $197.8 billion. Further, index members account for 43% of the 188 funds/share classes with $34.6 billion in actively managed world large cap funds as of December 31, 2019.

[1] While the definition of sustainable investing continues to evolve, this refers to a range of overarching investing approaches or strategies that encompass values-based investing, negative screening (exclusions), thematic and impact investing, environmental, social and governance (ESG) integration, company engagement and proxy voting. These are not mutually exclusive.