The Bottom Line: The only sustainable ETF launch in July 2022 is also the first commodity fund, subject to a high 80 bps expense ratio.

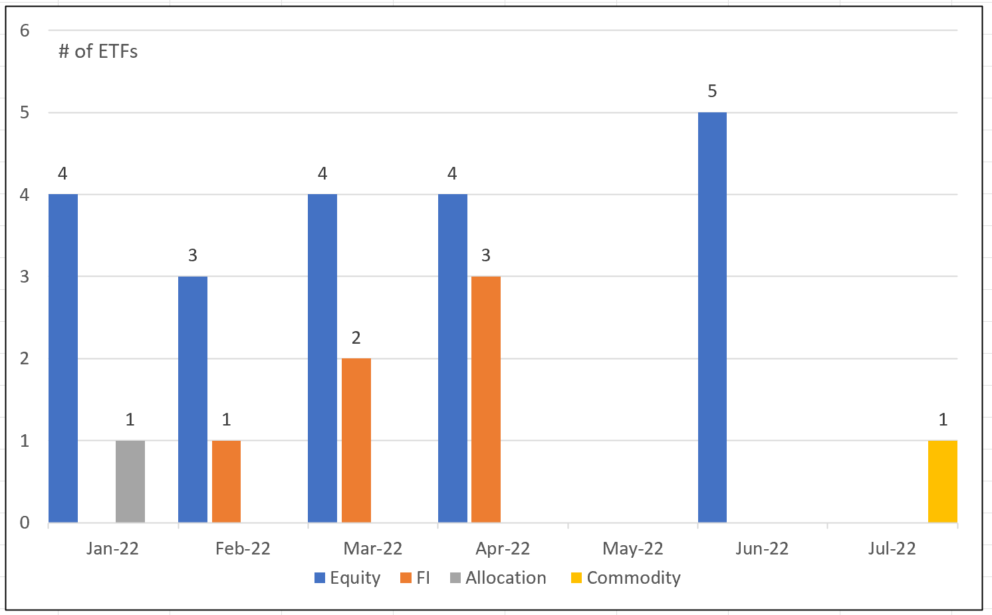

Number of sustainable ETFs launched in 2022 classified by their broad investment categories Source: Morningstar Direct

Source: Morningstar Direct

Observations

- The only sustainable ETF fund launch in July 2022 is also the first commodity fund in the sustainable ETF space.

- The Harbor Energy Transition Strategy ETF (RENW), sub-advised by Quantix Commodities LP, is an index tracking fund that seeks to provide investment results corresponding to the performance of the Quantix Energy Transition index, after fees and expenses. For an index fund, RENW is offered at a steep 80 bps, relative to an average expense ratio of 35 bps and a weighted average expense ratio of 25 bps levied by 161 sustainable index tracking ETFs as of May 2022. The expense ratio falls into the higher quartile of expense ratios calculated for sustainable index tracking ETFs that range from 0.05% to 1.29%.

- RENW was the 28th sustainable ETF to be launched so far this year, and the 11th index tracking fund. 17 ETFs launched in 2022 have been actively managed funds. The largest number of newly listed ETFs in 2022 have been equity and fixed income funds. The largest number of new launches occurred in April when 7 ETFs commenced operations while none were listed in May of the year.

- Launched just as most commodity prices have started to put the brakes on recently (the Bloomberg Commodities Index, which tracks more than 20 commodity futures including energy, metals, and livestock, has declined 19% since this year’s most recent high reached on June 9), the fund pursuant to its underlying index will be composed of futures contracts on physical commodities associated with the accelerating transition from carbon-intensive energy sources, such as petroleum, crude oil and thermal coal, to less carbon-intensive sources of energy, such as natural gas, ethanol, wind power, and solar power. The following commodity futures are eligible for inclusion in the Quantix Energy Transition index at this time: copper, aluminum, nickel, zinc, lead, natural gas (U.S.), natural gas (U.K.), natural gas (Europe), silver, palladium, platinum, soybean oil, ethanol and emissions based on European Union Allowances (EUA) and California Carbon Allowances (CCA).