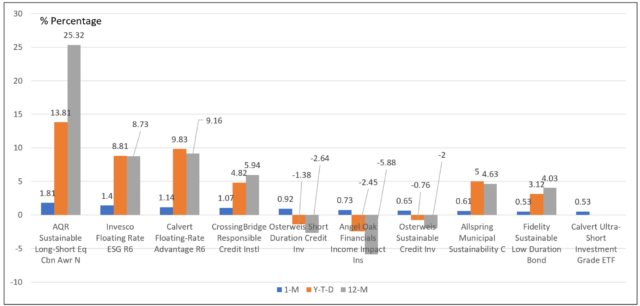

The bottom line: Best performing sustainable funds in August 2023 dominated by short-dated bond funds investing in fixed or floating rate securities and integrating ESG.

Sustainable mutual funds and ETFs: Top 10 performers in August 2023 Notes of Explanation: Performance results limited to best performing share class, to August 31, 2023. Calvert Ultra-Short Investment Grade ETF commenced operations on 1/30/2023. Sources: Morningstar Direct and Sustainable Research and Analysis.

Notes of Explanation: Performance results limited to best performing share class, to August 31, 2023. Calvert Ultra-Short Investment Grade ETF commenced operations on 1/30/2023. Sources: Morningstar Direct and Sustainable Research and Analysis.

Notes of Explanation: Performance results limited to best performing share class, to August 31, 2023. Calvert Ultra-Short Investment Grade ETF commenced operations on 1/30/2023. Sources: Morningstar Direct and Sustainable Research and Analysis.

Notes of Explanation: Performance results limited to best performing share class, to August 31, 2023. Calvert Ultra-Short Investment Grade ETF commenced operations on 1/30/2023. Sources: Morningstar Direct and Sustainable Research and Analysis. Observations:

- Sustainable mutual funds and ETFs posted an average decline of 2.58% in August, as both stocks and bonds edged lower. The S&P 500 gave up 1.59% in August and the Bloomberg US Aggregate Bond Index dropped 64 basis points, as investors started to contemplate the potential for higher interest rates over a longer period of time in the light of economic strength fed by consumer and government spending. Energy was the only positive sector.

- Only 131 funds recorded positive returns, or 8.2% of the 1,597 mutual funds/shares classes and ETFs in operation at the end of August with total net assets in the amount of $331.7 billion.

- Results range from a high of 1.81% achieved by the $31.8 million AQR Sustainable Long-Short Equity Carbon Aware Fund N to a low of -35.23% recorded by the Direxion Daily Electric and Autonomous Vehicles Bull 2X Shares, a thematic fund that seeks daily investment results of 200% of the performance of the US Electric and Autonomous Vehicles Index.

- The roster of performance leaders in August, posting an average 0.94 gain, was dominated by short duration fixed income mutual funds investing in fixed or floating rate securities, such as bank loan funds. The exception was AQR, which seeks to achieve its investment objective by investing in or having exposure to securities of US and foreign issuers through the construction of a long-short investment portfolio that favors attractive companies. Thes same top performing funds gained an average 4.53% and 5.24% year-to-date and over the trailing 12-months, respectively.

- Sustainable investing strategies employed by the top performing funds and their implementation approaches vary, but these range from expansive socially responsible principles to reliance on ESG integration combined with exclusionary screening applied to issuers and/or individual securities. AQR Sustainable Long-Short Equity Carbon Awareness Fund also specifically targets net zero carbon positioning. While some of the top performing mutual funds have been in operation for many years, sustainable investing strategies have been adopted more recently and investors should more closely examine intermediate and long-term performance track records as part of their due diligence process. For example, while the Angel Oak Financials Income Impact Fund Ins shares began operations in 2014, the fund’s name and investment strategies were changed as of September 2022.

![Performance-2-istockphoto-1402583424-612×612-1[1] Hot inflation data points to a record-high Social Security cost-of-living adjustment in 2023](https://sustainableinvest.com/wp-content/uploads/elementor/thumbs/Performance-2-istockphoto-1402583424-612x612-11-qkowut6jogizevgjlhpwke721x5hnod5gqsaals3ak.jpg)