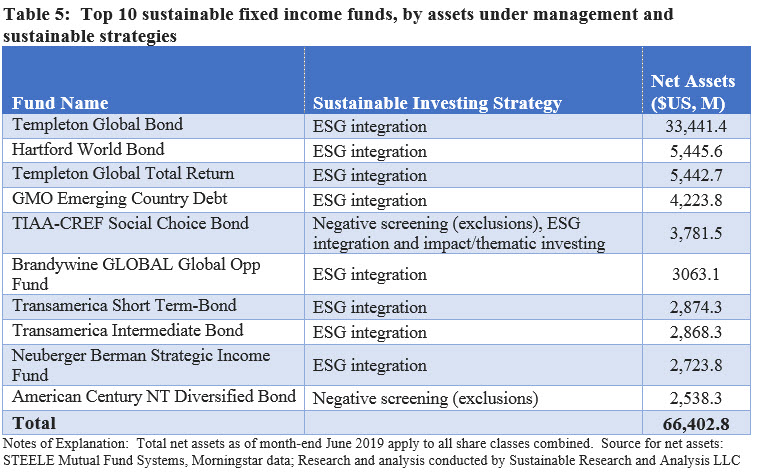

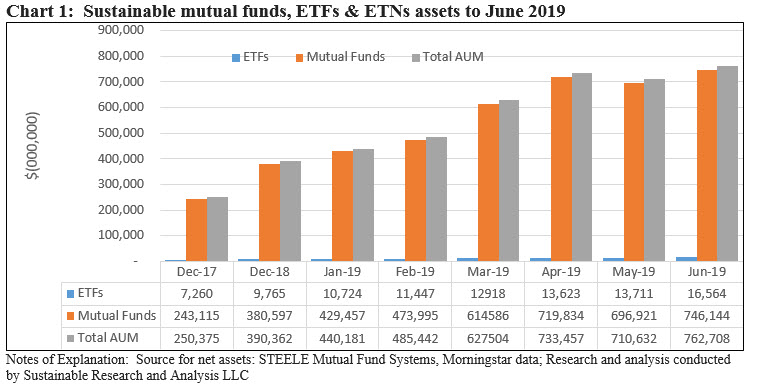

Assets attributable to sustainable funds snap back, adding $52.1 billion to end June at a new high level of $762.7 billion in assets under management

Reversing May’s $20.7 billion decline in assets under management, sustainable funds, including mutual funds, ETFs and ETNs, registered a net increase of $52.08 billion in assets under management, or 7.3% to end June 2019 at a new high level of $762.7 billion. The increase benefited from strong gains achieved in June across global markets and all major asset classes, with the S&P 500, for example, posting an increase of 7.05%. Indeed, market movement accounted for an estimated $38.8 billion of the gain, the largest gain this year based on market movement alone. Fund re-brandings added another $18.10 billion while at the same time net cash flows were negative in June. An estimated $4.81 billion in net cash outflows were experienced in June, reversing a positive flows trend that lasted four months from February to May. Refer to Chart 1.

Second quarter and year-to-date gains in net assets have been substantial and also in large part fueled by fund re-brandings. Year-to-date, sustainable funds added $372.3 billion in net assets or an increase of 95.4% while in Q2 net assets saw an increase of $135.2 billion or a gain of 21.6%. Since the start of the year, re-brandings accounted for $294.5 billion of the pick-up, or about 72%, while market movement contributed almost $70 billion and net cash flows an estimated $5.2 billion. Re-brandings accounted for a lower 62% of the increase in the second quarter, adding about $111.2 billion in net assets.

Sustainable mutual funds versus ETFs: Mutual funds account for about 97.8% of assets

Mutual funds ended the month of June with $746.1 billion, or 97.8% of assets under management. Sustainable ETFs, on the other hand, stood at $16.6 billion in assets at the end of June, representing just 2.2% of sustainable assets. Still, ETFs attracted net assets in the amount of $2.9 billion, or a month-over-month gain of 21%, the largest increase in 2019. In part, the gain is due to the May launch of the iShares ESG MSCI USA Leaders ETF which reached $1.4 billion at the end of June and benefited from more than $800 million that was reportedly invested by Ilmarinen, Finland’s largest pension insurance company.

Fixed income assets ended the month of June with $121.7 billion in assets, or 16.0% versus equity and all other funds that closed June with $625.9 billion, or 84% of sustainable assets under management.

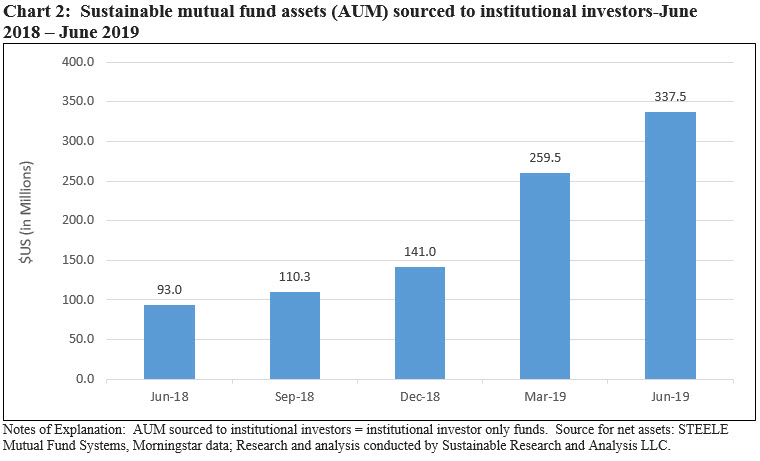

Institutional investors represent at least 45.2% of sustainable assets

As sustainable assets under management have expanded, so has the proportion of assets sourced to institutional investors which as of June 30 reached a minimum of $337.5 billion and makes up at least 45.2% of assets. This is up from $93.0 billion, or 33.9% twelve months earlier, with the increase due largely to the re-brandings of funds catering to institutional investors. Refer to Chart 2. Some categories of funds have much higher concentrations of institutional investors. For example in a recently published article on foreign funds generally and international funds in particular, it was noted that assets sourced to institutional investors is likely in excess of about 71%.

Index Funds: Still a small proportion of sustainable long-term mutual funds

Sustainable index mutual funds have attracted $15.4 billion in net assets across 51 funds/share classes as of June 2019. This represents only .002% of sustainable mutual fund assets under management relative to 22.4% for index funds relative to the non-sustainable long-term mutual funds population, using data as of year-end 2018.

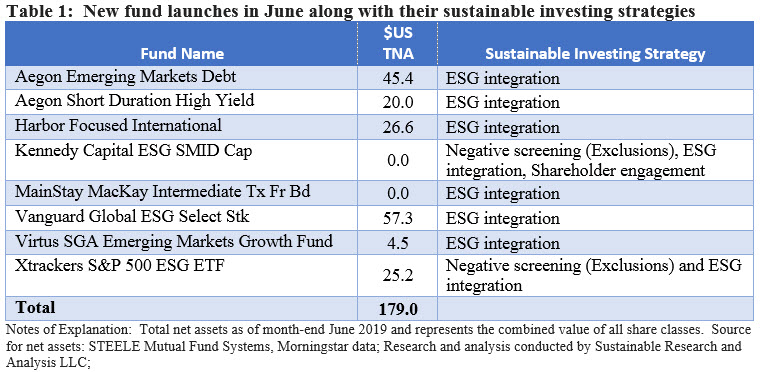

New Funds: Seven funds with $179 million in net assets launched in June

Six management firms introduced seven new mutual funds that were launched in June, adding 19 share classes and a combined total of $153.8 million in net assets. The largest of these is the Vanguard Global ESG Select Stock Fund that added a combined total of $57.3 million.

A seventh firm, Deutsche, launched the first of its kind ETF in the US seeking to replicate the performance of the recently created S&P 500 ESG Index. Refer to previously published article that details the construction of the index and its performance, entitled S&P Dow Jones Indices Launches S&P 500 ESG Index.

The sustainable investing strategies pursued by these firms is summarized in Table 1. All seven investment vehicles have adopted ESG integration strategies, with only two funds expanding beyond ESG integration to include negative screening and, in one instance, shareholder engagement. More details, to the extent provided in fund offering documents, may be found under the Funds Directory tab.

Curiously, the investment prospectus language adopted by three firms, Aegon, NYL/Mainstay (including the firm’s re-braded fund referenced later in the research article) and Virtus, note that ESG factors may be considered, which suggests that they may not be considered in all instances. This nuanced approach seems inconsistent with an ESG integration strategy and can lead to shareholder disillusionment and reputational risks for the management firm.

Fund Closings: One mutual fund and one ETF head for the dustbin

The $19.3 million Ariel Discovery Fund, which does not invest in companies whose primary source of revenue is derived from the production or sale of tobacco products or the manufacture of handguns as the company believed that these industries are more likely to face shrinking growth prospects, litigation costs and legal liability that cannot be quantified, was reorganized into the Ariel Fund following the Board’s approval on April 12, 2019.

Also approved to take place on or about August 1, 2019 is the liquidation of the $10 million Calvert Ultra-Short Duration Income NextShares (CRUSC) ETF. The Ultra-Short duration sustainable funds category is a small $1.4 segment where Calvert has been more successful with its mutual fund rather than ETF.

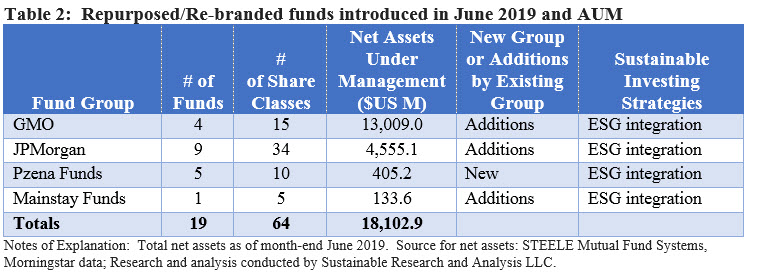

Repurposed or re-branded funds: Four firms, 19 funds, 64 share classes and $18.1 billion in assets

Four fund firms repurposed or re-branded existing funds in June, bringing along $18.1 billion in net assets. These included only one first time firm, Pezna Investment Management, LLC, that shifted five funds with $405.2 million.

The other three firms added to their roster of sustainable investing funds, including GMO, JPMorgan and Mainstay, a unit of New York Life. Refer to Table 2.

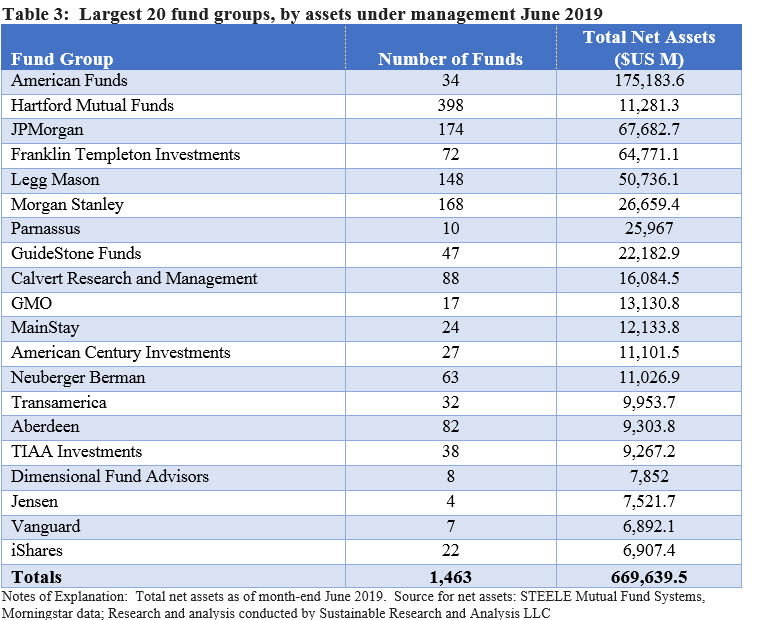

Largest Fund Groups: Top 20 sustainable fund groups account for 88.6% of net assets

A total of 145 fund groups offered sustainable mutual funds and ETFs at June 2019. Of these, the largest fund groups account for $669.6 billion or 87.8% of net assets, slightly down from the 88.6% of net assets under management as of the prior month. Refer to Table 3.

JPMorgan Funds became the third ranked sustainable fund firm as a result of rebranding nine additional funds with $4.6 billion in net assets as well as market movement and cash flows. Also, GMO made its way into the top 10 ranks, with the re-branding of four funds, comprised of 15 share classes, with $13.0 billion in net assets as of June month-end. It displaced Mainstay that shifted to 11th ranked fund group and pushed Pax World outside the top 20 ranked sustainable fund firms. iShares/BlackRock for the first time moved into the top tier and now ranks 20th with $6.9 billion in sustainable mutual funds and ETFs, having added almost $2 billion in ETF net assets month-over-month.

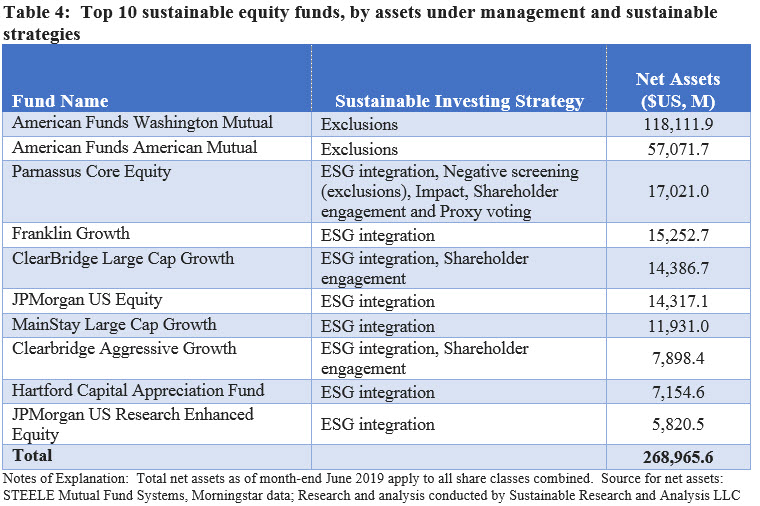

Largest Equity Funds: Top 10 sustainable equity funds account for $269 billion in assets or about 36% of the entire sustainable segment’s assets

The top 10 equity funds manage $269 billion in net assets and account for 36% of the segment’s total assets. Just the top two funds alone, both managed by American Funds, report $175.2 billion in net assets. These funds restrict themselves to excluding companies that derive the majority of their revenues from alcohol or tobacco products. The other eight, with the exception of Parnassus Core Equity, are not only recently re-branded funds but their sustainable investing approach is focused on ESG integration while ClearBridge Large Cap Growth also relies on shareholder engagement. Refer to Table 4.

Largest Bond Funds: Top 10 sustainable bond funds account for $66.4 billion in assets or about 8.9% of the entire sustainable segment’s assets

The largest 10 bond funds account for $66.4 billion in net assets or about 8.9% of the entire sustainable segment’s assets under management. The largest of these, the $33.4 billion Templeton Global Bond, makes up 50.4% of this 10-fund universe, which largely consists of funds that have been rebranded in the recent past. The two exceptions are TIAA-CREF Social Choice Bond Fund and American Century NT Diversified Bond—the only one of ten funds whose sustainable strategy is limited to negative screening for tobacco companies. Otherwise, ESG integration strategies dominate. Refer to Table 5.