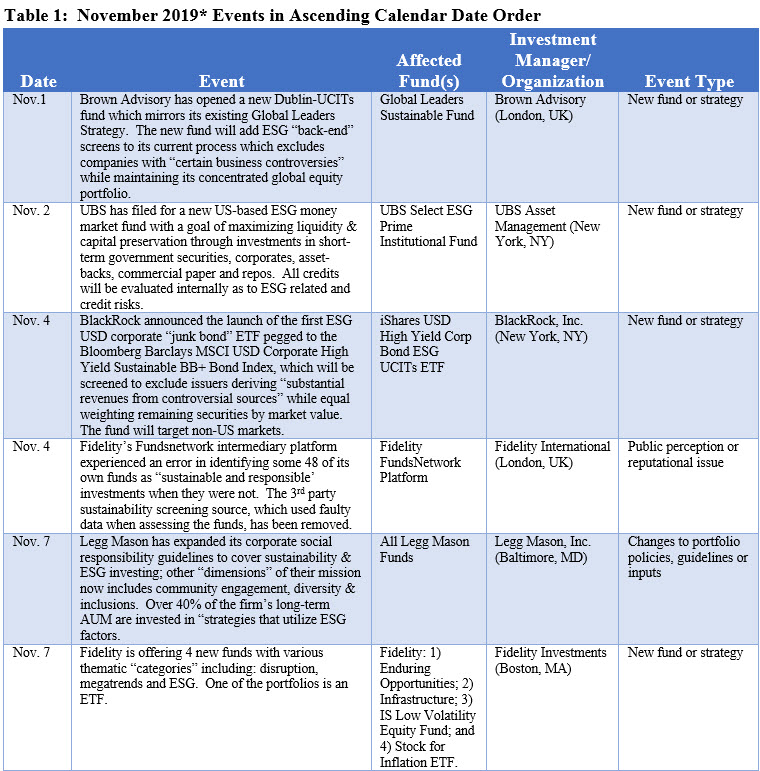

Events Summary

Twenty-three US and non-US sustainable fund-related events were identified in November 2019 including:

• 14 of these events involved the launch of new funds or strategies in the US and overseas

–These included 7 U.S.-based and 7 non-U.S.-based products.

–Three involved money market funds, including one Euro money market fund

• Three events involved portfolio management team changes.

• Three events involved changes to portfolio policies, guidelines or inputs.

• One event involved an analytical process error and a potential for negative “public perception or reputational issue.”

• One event was sourced to a new analytical tool, research or indices.

• One event was sourced to a new analytical tool, research or indices.

• One event was associated with a competitive/strategic move or repositioning.

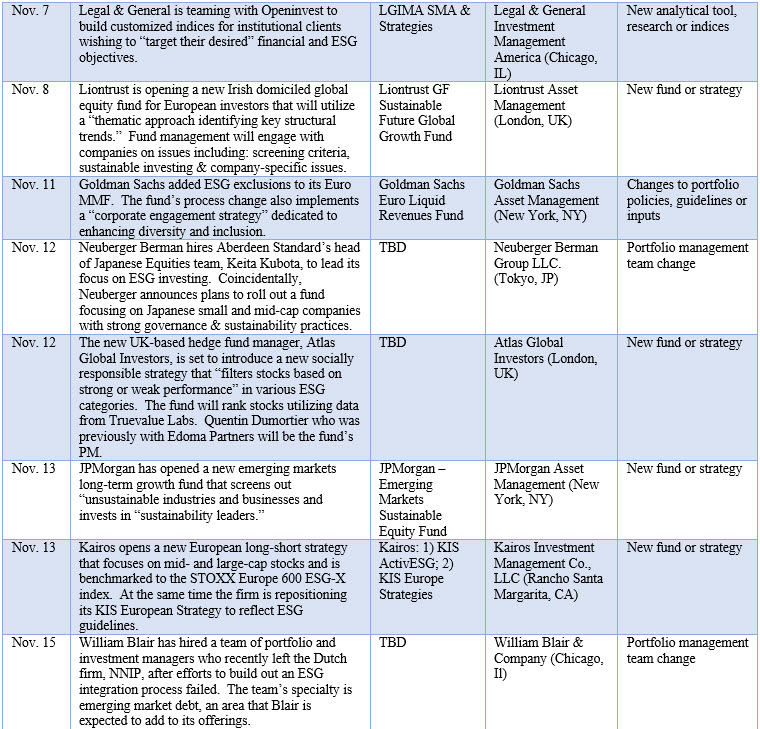

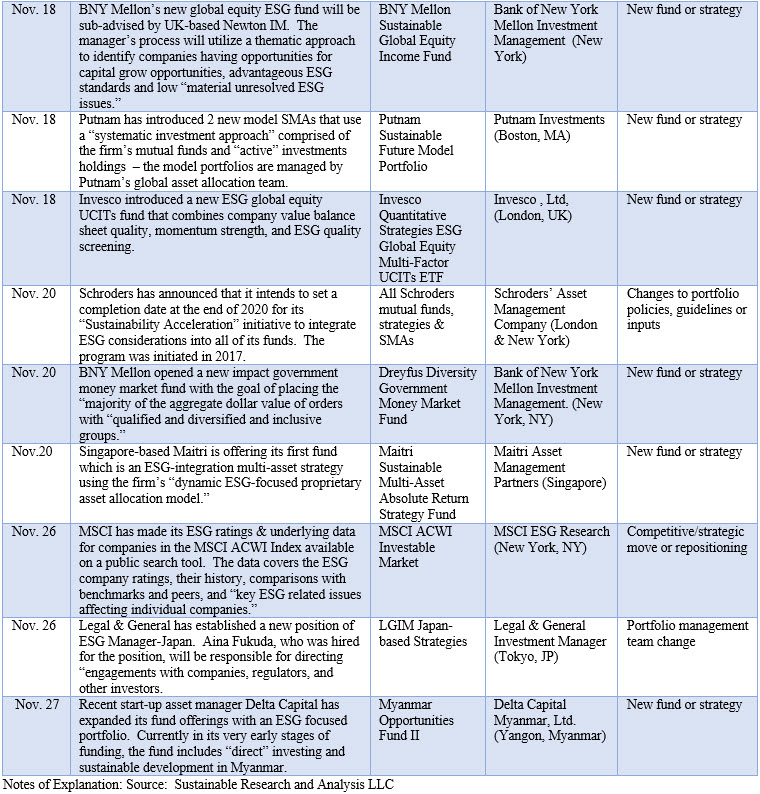

See Table 1 for details.