Recent Reports Raise Questions Regarding TIAA Sales Practices

It was recently reported in The New York Times (NYT) that New York State’s Attorney General subpoenaed TIAA, the financial services organization, seeking documents and information relating to the firm’s sales practices. The action was taken following the October publication of an article in the NYT that raised questions about the TIAA’s selling practices. In particular, the action appears to be linked to disclosures by former employees who felt that they were pressured to sell products generating more revenue for the firm but were more costly to clients while adding little value. This raises questions regarding TIAA’s conduct as a fiduciary as well as concerns about its governance practices more generally and whether the firm might have breached any federal laws governing how it interacts with clients. This revelation is a shock, given TIAA’s reputation as a highly ethical company. TIAA’s core values are to “take care of people, act with integrity and deliver excellence.” If validated, however, the Attorney General’s actions could lead to the filing of civil or criminal charges. At this point, the investigation is still in a very early phase and TIAA announced that it is cooperating fully with regulators. TIAA has also begun its own investigation, but it may take some time to reach closure. In the meantime, the reports are troubling and sustainable fund investors in TIAA’s sustainable mutual funds as well as exchange-traded funds (ETFs) have reason to be concerned about how the firm’s actions, this investigation and potential ramifications might affect these investments and what actions, if any, to take at this juncture. TIAA offers a total of 12 sustainable investment vehicles, including four mutual funds and 20 share classes in total, and eight ETFs, with about $4.5 billion in assets under management advised or sub-advised by Teachers Advisors, LLC, a wholly owned indirect subsidiary of Teachers Insurance and Annuity Association of America (TIAA). These allegations, which should be considered within the context of the TIAA’s otherwise outstanding reputation, do not appear to directly affect the investment activities of the sustainable mutual funds and ETFs offered by the firm, or, for that matter, other funds distributed by TIAA that may have been purchased directly or through financial advisors independent of TIAA. At this stage, it would be premature for investors to take any action to either sell or curtail future investments in any of TIAA’s sustainable funds. At the same time, investors should be vigilant and monitor developments in the case as it moves forward, continue to evaluate fund performance and remain alert to any new announcements relating to the TIAA sales practices investigation.

Rebranded in 2016, TIAA, the World’s 20th Largest Asset Management Firm, Has Enjoyed a Reputation as a Highly Ethical Company

TIAA, formerly TIAA-CREF, or Teachers Insurance and Annuity Association—College Retirement Equities Fund, is a Fortune 100 financial services organization offering a wide range of products to the general public while continuing to serve its core constituents in the academic, medical and research fields. Its TIAA Global Asset Management unit, operating as a multi-boutique structure, is the 20th largest asset management firm in the world with about $882 billion in assets under management[1]. TIAA enjoys a reputation as a highly ethical company. For example, for the third straight year, TIAA was recognized again in 2017 as one of the World’s Most Ethical Company by the Ethisphere Institute based on TIAA’s “role in society to influence and drive positive change, consider the impact of their actions on their employees, investors, customers and other key stakeholders and use their values and culture as an underpinning to the decisions they make every day.[2]”

TIAA has been engaged in sustainable investing since the 1970’s and offers a suite of sustainable mutual funds available to the public since the launch of the Social Choice Equity Fund in 1999. Since then, TIAA has expanded its sustainable fund offerings by introducing a US bond fund in 2012 and an international equity fund as well as a low-carbon equity fund in 2015. The TIAA Social Choice Bond Fund, in particular, has delivered outstanding results since its launch, beating the non-ESG Bloomberg Barclays U.S. Aggregate Bond Index in each of the last one, three and five year intervals across all share classes. Refer to previously published Product Profile. The same, however, can’t be said about the Social Choice Equity Fund. At the same time, the performance results achieved by the latest offerings, including the Low-Carbon Equity Fund and related five share classes that have outperformed their non-ESG benchmark based on 12-month results to October 31, 2017, do not extend beyond a full year given their launch in the third-quarter 2015.

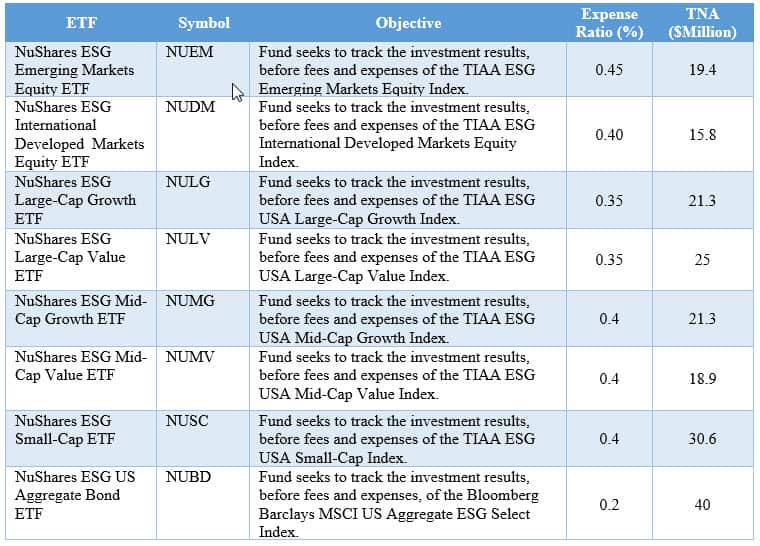

Following the acquisition of Nuveen Investments in 2014, TIAA rebranded its asset management arms under the Nuveen imprint and expanded its sustainable fund offerings by launching for the first time index tracking ETFs, eight in total to-date, each of which integrates environmental, social and governance (ESG) factors into the relevant index. These low cost ETF options, which have been trading since June 2016 and December 2017, are listed in Table 2.

TIAA was founded in 1918 as a nonprofit organization with a $1.0 million grant from the Carnegie Foundation to provide investment products that would generate retirement income for teachers who were not covered under traditional pension schemes. TIAA remained a nonprofit organization until 1997, when Congress revoked its tax exemption. Most of TIAA’s clients invest with the firm because their employers have hired it to administer their workers’ retirement plans. These include some 15,000 colleges, hospitals and other nonprofit organizations. TIAA typically acts as record keeper to these institutions, administering accounts that allow plan participants to choose among an array of mutual funds and annuities. When TIAA is a plan’s record keeper, its in-house funds are typically among the investments offered. The company earns a record-keeping fee from the institutions whose accounts it oversees, but can generate more revenue when investors buy its annuities and funds, including purchases of such products based on guidance provided by TIAA’s more than 850 financial advisors[3]. This function presents opportunities for potential conflicts that must be governed carefully and effectively.

The Allegations Against TIAA and Its Sales Practices

The New York State Attorney General Eric Schneiderman subpoenaed information from TIAA regarding its sales practices. The subpoenaing of information from TIAA followed allegations of predatory sales practices used by the firm that was reported in an October 21, 2017 New York Times article. The NYT story, based in part on a whistleblower complaint obtained by the Times that was filed by former TIAA workers with U.S. Securities and Exchange Commission regulators, disclosed that TIAA representatives pressured customers into buying financial products that add little or no value for them but generate higher fees. The story also cited interviews with 10 former TIAA employees who said they were given hard-to-meet sales quotas, coupled with instructions from management to meet the quotas by increasing clients’ fears of having insufficient retirement funds and by finding other “pain points.” The article further stated that the whistleblower complaint alleges that TIAA began a fraudulent scheme in 2011 to convert “unsuspecting retirement plan clients from low-fee, self-managed accounts to TIAA-CREF-managed accounts” that cost more.

According to the NYT, TIAA has said in the past that its financial advisers and consultants do not get commissions on products they sell, a rule that helps to protect investment clients. But former employees reportedly told the NYT that the firm gives out bonuses to salespeople who convince customers to purchase more expensive TIAA products and services. For example, investors might have been encouraged to transfer funds from institutional plans, where annual costs may be about 0.3% of assets under management, into managed accounts with fees ranging from 0.7% to 1.0%.

TIAA Sustainable Mutual Fund Offerings and ETFs

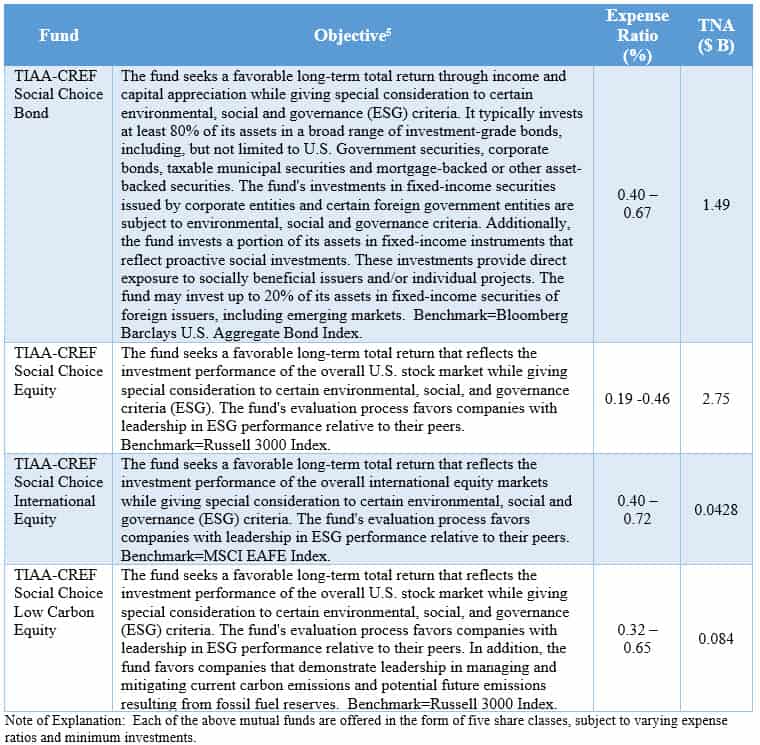

The following table lists the sustainable mutual funds offered and managed by TIAA. The listed funds can be purchased directly by investors, through financial advisors or through retirement plans that offer these funds as investment options.

Table 1: Sustainable Equity and Bond Funds Offered by TIAA, Including Fund Objectives, Share Classes/Expense Ratios and Total Net Assets (TNA)[4]

Table 2 lists the sustainable exchange-traded funds offered by TIAA. These are listed for trading on the NYSE.

Table 2: Listing of Sustainable ETFs Offered by TIAA, Including Objectives, Expense Ratios and Net Assets

Investor Action Steps

The investigation is still in a very early phase and TIAA announced that it is cooperating fully with regulators. It may take some time to reach closure. These allegations, which should be considered within the context of the TIAA’s otherwise outstanding reputation, do not directly impact the investment activities of the sustainable mutual funds and ETFs offered by the firm or its affiliates, or, for that matter, other funds distributed by TIAA that may have been purchased directly or through financial advisors independent of TIAA. At this stage, it would be premature for investors to take any action to either sell or curtail future investments in any of TIAA’s sustainable funds. At the same time, investors should be vigilant and monitor developments in the case as it moves forward, continue to evaluate fund performance and remain alert to any new announcements relating to the TIAA sales practices investigation.

[1] P&I/Willis Towers Watson: The World’s 500 Largest Asset Managers.

[2] Source: Ethisphere Institute, based on Ethics Quotient (EQ) Framework.

[3] TIAA Q2 2017 Facts and Stats.

[4] Expense ratios range across share classes; B=Billions.