Model portfolios: Reversing course in August, the performance of each of the three sustainable portfolios were eclipsed by conventional benchmarks

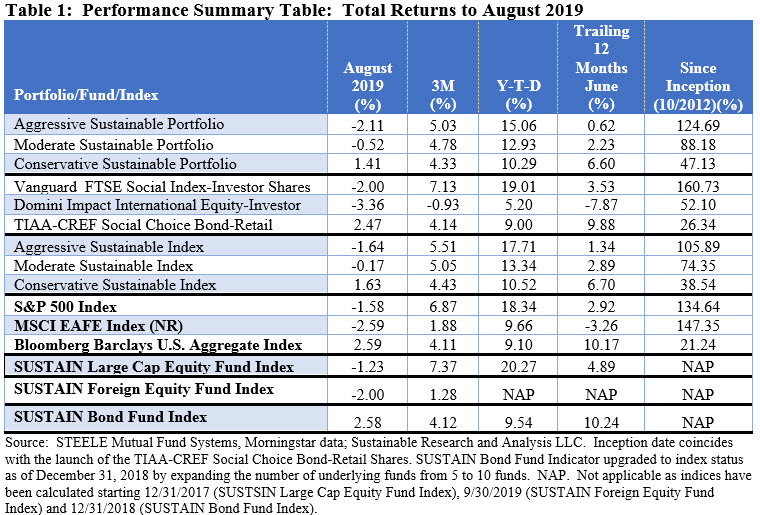

A volatile August driven by trade tensions between the US and China, geopolitical uncertainties and signs of an economic slowdown in the US and overseas produced opposite results for equities and fixed income securities but still left the three sustainable model portfolios trailing behind their conventional benchmarks. US and foreign equities as measured by the S&P 500 Index and MSCI EAFE (NR) Index were down -1.58% and -2.60% while intermediate investment-grade bonds shut out the lights with a return of 2.60%. In turn, market results affected the performance of the underlying funds that comprise the sustainable portfolios, namely the Vanguard FTSE Social Index Fund Investor shares, -2.0%, the Domini International Equity Investor shares, -3.36%, and the TIAA-CREF Social Choice Bond Fund Retail shares, 2.47%. Each of the funds also lagged behind their conventional indices. Refer to Table 1.

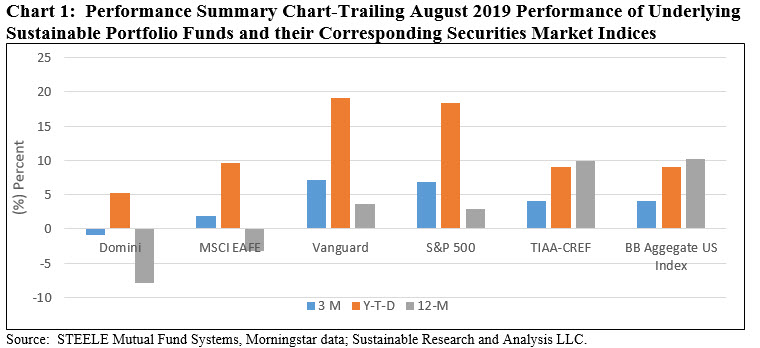

Against this backdrop, the Conservative Sustainable Portfolio (20% stocks/80% bonds), Moderate Sustainable Portfolio (60% stocks/40% bonds) and Aggressive Sustainable Portfolio (95% stocks/5% bonds) posted index lagging returns of 1.41%, -0.52% and -2.11%, respectively. As well, the three portfolios trailed behind their conventional indices over the preceding 3-month, year-to-date and 12-month intervals. While the Vanguard FTSE Social Index Fund Investor shares has beaten the S&P 500 over the last year, its strong returns have been offset by the relative results recorded by both Domini and TIAA-CREF. Refer to Chart 1.

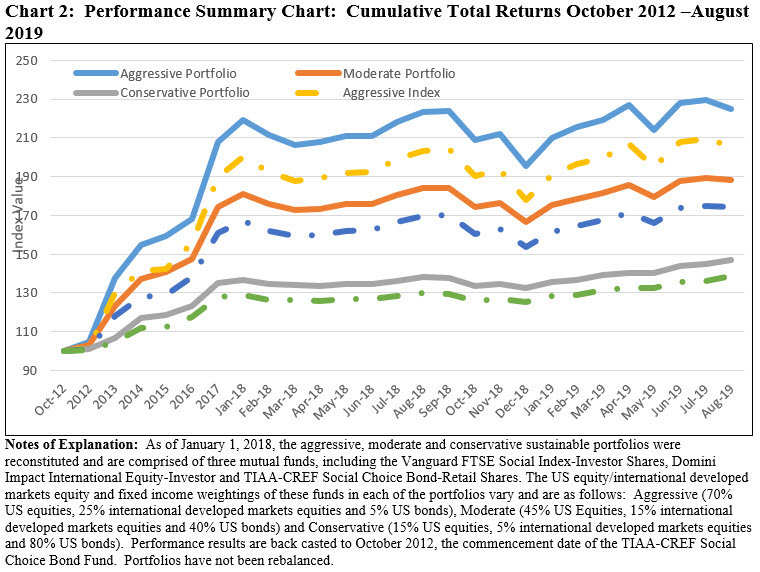

Still, the three sustainable portfolios continue to outperform their conventional benchmarks since inception as of October 2012 by wide margins. Refer to Chart 2.

Stock market registers -1.58% decline in volatile month while bonds blew the lights out and sustainable indices, for the most part, outperformed conventional benchmarks

A volatile August ended the last week of the month as it began but with opposite outcomes, driven by trade tensions between the US and China, geopolitical uncertainties and signs of an economic slowdown in the US and overseas. By month-end, the broad market as measured by the S&P 500 closed down -1.58% while the Dow Jones Industrial Average gave up -1.32% and the Nasdaq Composite dropped -2.46%. Refer to Chart 1. Small company stocks ended even lower, giving up -4.94% as measured by the Russell 2000 Index. Growth stocks outperformed value stocks while large caps eclipsed their small cap counterparts. Foreign markets also ended lower while at the same time, bonds generally, and long-dated bonds in particular, blew out the lights in August. Long dated Treasury and US government indices gained over 10% and the intermediate-term Bloomberg Barclays US Aggregate Bond Index added 2.59%. For the most part, sustainable equity, foreign, emerging market stock, bonds as well as fund indices outperformed conventional indices. For additional details, refer to article entitled SUSTAIN Indices Post Competitive Returns: August 2019 Update.