The Bottom Line: The SEC’s Division of Examinations (DE) issued an advisory Risk Alert highlighting observations from recent exams focusing on ESG products and services.

Confusion in the Marketplace

On April 9th, the Securities and Exchange Commission’s Division of Examinations (DE) issued an advisory Risk Alert for the purpose of highlighting observations from recent exams of investment advisers, registered investment companies, and private funds offering ESG products and services. According to the Division, the dramatic growth in the number of ESG product offerings in recent years combined with the lack of standardized and precise ESG definitions have introduce certain risks in the form of confusion among investors, especially retail investors, and investment advisers. The Risk Alert identifies a number of potentially misleading statements and practices observed during recent SEC examinations that are juxtaposed against examples of effective practices.

Warning Shot

The Division, which uses the term “ESG” in the broadest sense to encompass a variety of sustainable investing strategies but stops short of defining these, is sending a warning shot to firms that promote ESG investing to clients, prospective clients, investors, and prospective investors to evaluate whether their disclosures, marketing claims, and other public statements related to ESG investing are accurate and consistent with internal firm practices. Additionally, firms are advised to ensure that their approaches to ESG investing are:

-

- implemented consistently throughout the firm,

- adequately addressed in the firm’s policies and procedures and subject to appropriate oversight by compliance personnel,

- adequately documented with regard to the important stages of the ESG investing process.

Call for Standards

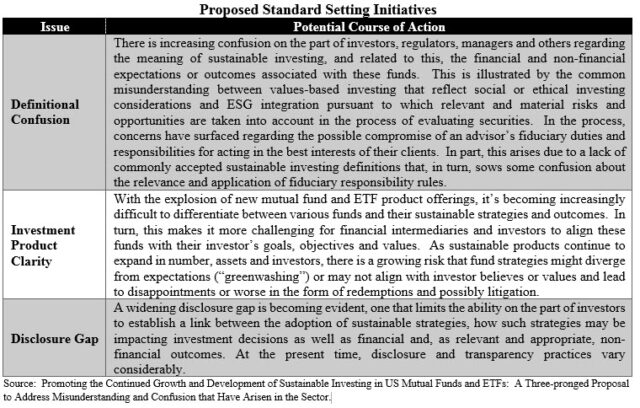

The expression of concerns on the part of the DE regarding a disconnect that was found to exist between ESG product offerings, on the one hand, and the implementation of such ESG related approaches on the other, does not come as a surprise. Unprecedented growth in sustainable investment product offerings in the US, involving mutual funds and ETFs that was largely attributable to fund re-brandings, followed by market appreciation and net cash inflows, has been contributing to confusion. In part, this has led to an increasingly common misunderstanding on the part of stakeholders as to the differences between values-based investing, reflecting social or ethical investing considerations, and environmental, social and governance (ESG) integration, pursuant to which relevant and material risks and opportunities are taken into account in the process of evaluating securities. To ensure continued growth and development in the sustainable investing sector and to allow it to reach its full potential, Michael Cosack and Henry Shilling advocated for the adoption of standard setting initiatives, including the adoption of standardized definitions, creation of accepted mutual fund/ETF product classification framework and the adoption of an effective disclosure framework, as set forth in their May 2020 published paper[1] and summarized in the table below.

Conclusion

The Risk Alert, which is non-binding, sets out areas of focus for the Division of Examination during upcoming examinations of firms that claim to engage in ESG investing, including portfolio management, performance advertising and marketing and compliance programs. The Division of Examinations should be applauded for highlighting these issues in the form of a Risk Alert that represents a wake-up call for the investment company industry to take up the challenge of developing widely accepted standardized and more precise sustainable investing definitions, a framework for investment products classifications as well as a set of disclosure practices. It is now up to the investment management industry to respond. Otherwise, it seems likely that the SEC will take up such an initiative.

[1] Promoting the Continued Growth and Development of Sustainable Investing in US Mutual Funds and ETFs: A Three-pronged Proposal to Address Misunderstanding and Confusion that Have Arisen in the Sector, Michael Cosack and Henry Shilling, May 2020. https://sustainableinvest.com/rapid-growth-in-esg-funds-calls-for-adoption-of-standards/